Geico does renters insurance cover storage units

Overview of renters insurance coverage for storage units

Renters insurance provides some coverage for items in a storage unit, but there are limits. While the specifics may vary depending on the insurance policy, most renters insurance policies typically provide coverage for personal belongings both inside and outside the insured residence. This means that if you have renters insurance, your personal belongings are generally protected whether they are inside your apartment or in a storage unit.

However, it’s important to note that the coverage provided for items in a storage unit may be limited compared to the coverage for items kept inside your rented home. The insurance policy may have a separate coverage limit for items stored in a storage unit, which is typically lower compared to the coverage limit for items inside your residence. It’s important to review your policy or consult with your insurance provider to understand the coverage and limitations specific to your renters insurance policy.

Importance of having insurance for stored possessions

Having insurance coverage for the items stored in a storage unit is important for several reasons.

1. Protection against theft or damage: Renters insurance typically provides coverage for theft or damage to your personal belongings. This means that if your items are stolen or damaged while in storage, you may be able to file a claim and receive compensation.

2. Peace of mind: Knowing that your possessions are protected by insurance can provide peace of mind. You can rest assured that in case of any unexpected incidents, such as a fire or burglary, you have financial protection in place.

3. Affordable coverage: Renters insurance is generally affordable and provides coverage not only for your personal belongings inside your rented home but also for items stored in a storage unit. The cost of renters insurance may vary depending on factors such as the coverage limits, deductibles, and location, but it is often a small price to pay for the peace of mind it provides.

4. Liability coverage: In addition to covering your personal belongings, renters insurance typically also includes liability coverage. This means that if someone is injured in your storage unit or if you accidentally damage someone else’s property while using the storage unit, your renters insurance may provide coverage for legal expenses and medical bills.

Therefore, renters insurance does provide coverage for items stored in a storage unit, but there are limits to this coverage. It’s important to review your policy and understand the specific coverage and limitations related to your renters insurance. Having insurance for your stored possessions is important for protection against theft or damage, peace of mind, affordability, and liability coverage.

Understanding Renters Insurance Coverage

Explanation of personal property coverage on a renters policy

When it comes to renters insurance, it’s important to understand what is covered and what is not. Renters insurance typically includes coverage for personal property, liability protection, and additional living expenses. Personal property coverage provides reimbursement for the loss or damage of belongings due to covered perils, such as fire, theft, or vandalism. This coverage extends not only to items inside the rented dwelling but also to items outside, such as those in a storage unit.

Limitations and exclusions of coverage for stored items

While renters insurance does provide some coverage for items stored in a storage unit, there are limits to this coverage. The specific amount of coverage may vary depending on the insurance policy, but typically it is a percentage of the overall personal property coverage. For example, if the policy has $50,000 in personal property coverage, the coverage for stored items might be limited to 10% or $5,000.

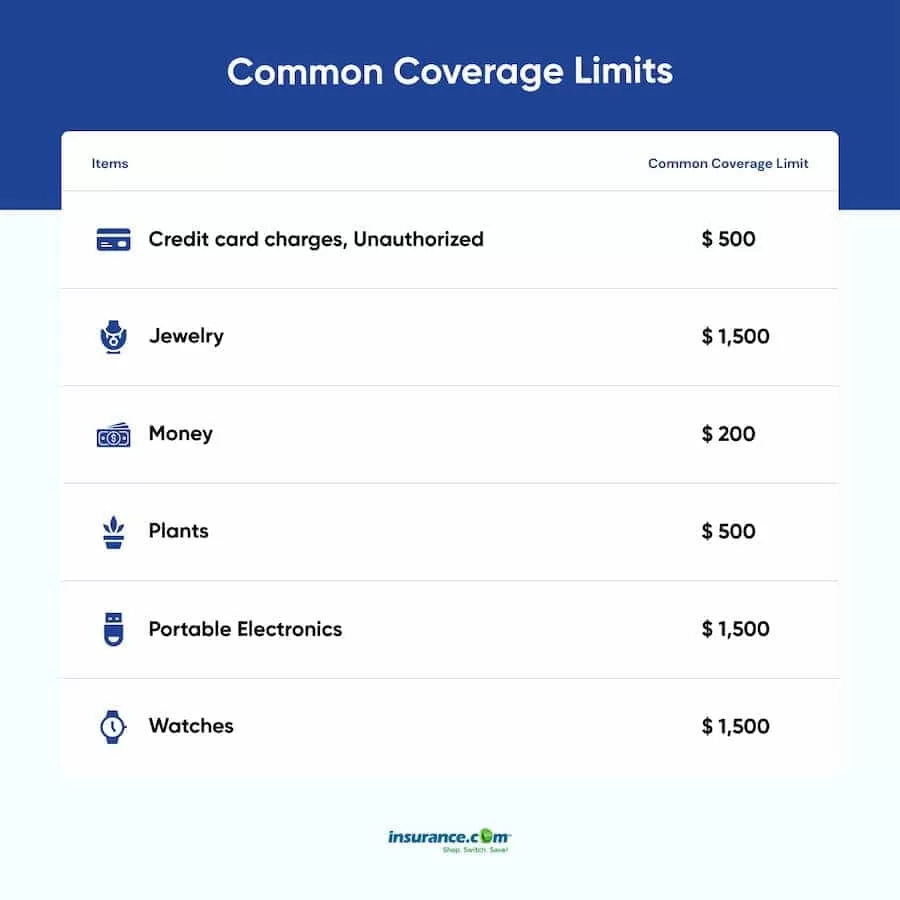

It’s important to note that certain high-value items, such as jewelry, electronics, or collectibles, may have sub-limits within the policy. This means that the coverage for these specific items may be lower than the overall coverage for personal property. It’s a good idea to review the policy carefully and consider purchasing additional coverage or a separate policy for these high-value items.

Additionally, renters insurance does not cover damage caused by certain perils, such as flooding or earthquakes. If the storage unit is damaged or destroyed by a covered peril, the belongings stored inside may not be covered. It’s essential to understand the specific exclusions and limitations in the insurance policy.

If the storage unit is located in a different state than the insured dwelling, there may also be limitations on coverage. Some insurance policies only provide coverage within a certain geographic area. It’s important to check with the insurance provider to determine if the storage unit’s location impacts the coverage.

Therefore, while renters insurance does offer some coverage for items stored in a storage unit, it’s important to understand the limitations and exclusions. Reviewing the policy and considering additional coverage for high-value items can help ensure that personal belongings are adequately protected.

GEICO Renters Insurance Coverage

Details of renters insurance coverage provided by GEICO

When it comes to renters insurance, GEICO offers comprehensive coverage for personal property, liability protection, and additional living expenses. This means that not only are your belongings inside your rented dwelling covered, but also items outside, such as those in a storage unit. GEICO provides reimbursement for the loss or damage of belongings due to covered perils, including fire, theft, or vandalism.

Percentage of coverage for stored belongings

While GEICO renters insurance does offer coverage for items stored in a storage unit, there are limits to this coverage. The specific amount of coverage may vary depending on the insurance policy, typically being a percentage of the overall personal property coverage. For example, if your policy has $50,000 in personal property coverage, the coverage for stored items might be limited to 10%, which would be $5,000.

It’s important to note that certain high-value items, such as jewelry, electronics, or collectibles, may have sub-limits within the policy. This means that the coverage for these specific items may be lower than the overall coverage for personal property. To ensure adequate protection for these high-value items, it’s recommended to review your policy carefully and consider purchasing additional coverage or a separate policy.

Additionally, it’s important to be aware that renters insurance does not cover damage caused by certain perils, such as flooding or earthquakes. If a covered peril damages or destroys the storage unit, the belongings stored inside may not be covered. It’s crucial to understand the specific exclusions and limitations in your insurance policy.

Furthermore, if the storage unit is located in a different state than your insured dwelling, there may be limitations on coverage. Some insurance policies only provide coverage within a certain geographic area. To determine if the storage unit’s location impacts your coverage, it’s advisable to check with your GEICO insurance provider.

Therefore, GEICO renters insurance does provide coverage for items stored in a storage unit. However, it’s essential to understand the limitations and exclusions of this coverage. Reviewing your policy and considering additional coverage for high-value items can help ensure that your personal belongings are adequately protected. Remember to always consult with your insurance provider to fully understand the details of your renters insurance coverage.

Nationwide Renters Insurance Coverage

Overview of renters insurance coverage offered by Nationwide

Nationwide offers renters insurance policies that provide coverage for personal property, liability protection, and additional living expenses. With Nationwide renters insurance, policyholders can have peace of mind knowing that their belongings are protected against covered perils such as fire, theft, or vandalism. In addition to coverage for items inside the rented dwelling, Nationwide renters insurance also extends coverage to items stored in a storage unit.

Extent of coverage for items in a storage unit

While Nationwide renters insurance does provide coverage for items stored in a storage unit, it’s important to understand the limitations and exclusions. The specific amount of coverage for stored items may vary depending on the policy, typically being a percentage of the overall personal property coverage. For instance, if a policy has $50,000 in personal property coverage, the coverage for items in a storage unit might be limited to 10%, or $5,000.

It’s worth noting that certain high-value items, such as jewelry, electronics, or collectibles, may have sub-limits within the policy. This means that the coverage for these specific items may be lower than the overall coverage for personal property. To ensure adequate protection for these high-value items, policyholders can consider purchasing additional coverage or a separate policy specifically tailored to cover them.

Furthermore, Nationwide renters insurance does not cover damage caused by certain perils, including flooding or earthquakes. If a storage unit is damaged or destroyed due to a covered peril, the belongings stored inside may not be covered. It’s crucial for policyholders to review the specific exclusions and limitations outlined in their insurance policy.

Policyholders should also keep in mind that the location of the storage unit can impact the coverage. Some insurance policies may only provide coverage within a certain geographic area. It’s essential to consult with Nationwide or their insurance provider to determine if the location of the storage unit affects the coverage.

Therefore, Nationwide renters insurance does offer coverage for items stored in a storage unit. However, it’s important for policyholders to be aware of the limitations and exclusions, as well as consider additional coverage for high-value items. Reviewing the insurance policy carefully and discussing any concerns with Nationwide can help ensure that personal belongings are adequately protected.

Nationwide Renters Insurance Coverage

Overview of renters insurance coverage offered by Nationwide

Nationwide provides renters insurance policies that offer coverage for personal property, liability protection, and additional living expenses. With Nationwide renters insurance, policyholders can have peace of mind knowing that their belongings are protected against covered perils such as fire, theft, or vandalism. Coverage is extended to items stored in a storage unit.

Extent of coverage for belongings stored in a storage unit

While Nationwide renters insurance does cover items stored in a storage unit, there are limitations and exclusions that policyholders should be aware of. The specific amount of coverage for stored items may vary depending on the policy, typically being a percentage of the overall personal property coverage. For example, if a policy has $50,000 in personal property coverage, the coverage for items in a storage unit might be limited to 10%, or $5,000.

Certain high-value items, such as jewelry, electronics, or collectibles, may have sub-limits within the policy. This means that the coverage for these specific items may be lower than the overall coverage for personal property. To ensure adequate protection for these high-value items, policyholders can consider purchasing additional coverage or a separate policy specifically tailored to cover them.

Additionally, it’s important to note that Nationwide renters insurance does not cover damage caused by certain perils, such as flooding or earthquakes. If a storage unit is damaged or destroyed due to a covered peril, the belongings stored inside may not be covered. It’s crucial to review the specific exclusions and limitations outlined in the insurance policy.

The location of the storage unit can also impact coverage. Some insurance policies may only provide coverage within a certain geographic area. It’s essential to consult with Nationwide or the insurance provider to determine if the location of the storage unit affects the coverage.

So, Nationwide renters insurance does offer coverage for belongings stored in a storage unit. However, policyholders should be aware of the limitations, exclusions, and sub-limits that may apply. Reviewing the insurance policy carefully and discussing any concerns with Nationwide can help ensure that personal belongings are adequately protected.

USAA Renters Insurance Coverage

Details of renters insurance coverage provided by USAA

USAA offers renters insurance policies that provide comprehensive coverage for personal property, liability protection, and additional living expenses. USAA renters insurance policies are designed to protect policyholders against covered perils, such as fire, theft, or vandalism. In addition to coverage for belongings inside the rented dwelling, USAA renters insurance also extends coverage to items stored in a storage unit.

Coverage limitations for stored possessions

While USAA renters insurance does offer coverage for items stored in a storage unit, it’s important to understand the limitations and exclusions. The specific coverage limit for stored items may vary depending on the policy, typically being a percentage of the overall personal property coverage. For example, if a policy has $50,000 in personal property coverage, the coverage for items in a storage unit might be limited to 10%, or $5,000.

It’s important for policyholders to note that certain high-value items, such as jewelry, electronics, or collectibles, may have sub-limits within the policy. This means that the coverage for these specific items may be lower than the overall coverage for personal property. To ensure adequate protection for these high-value items, policyholders can consider purchasing additional coverage or a separate policy specifically tailored to cover them.

Additionally, USAA renters insurance does not cover damage caused by certain perils, such as flooding or earthquakes. If a storage unit is damaged or destroyed due to a covered peril, the belongings stored inside may not be covered. It’s crucial for policyholders to review the specific exclusions and limitations outlined in their insurance policy.

Policyholders should also be aware that the location of the storage unit can impact coverage. Some insurance policies may only provide coverage within a certain geographic area. It’s important to consult with USAA or the insurance provider to determine if the location of the storage unit affects the coverage.

Therefore, USAA renters insurance does offer coverage for items stored in a storage unit. However, policyholders should be aware of the coverage limitations, exclusions, and potential sub-limits for high-value items. Reviewing the insurance policy in detail and discussing any concerns with USAA or their insurance provider can help ensure that personal belongings are adequately protected.

Storage Unit Operator Requirements

Explanation of why storage unit operators ask for proof of insurance

Storage unit operators often require renters to provide proof of insurance before allowing them to rent a storage unit. This requirement is in place to protect both the renter and the operator in case of any unforeseen events or damages. By requiring proof of insurance, storage unit operators ensure that there is coverage in place to compensate for any loss or damage to the stored items.

When a storage unit operator asks for proof of insurance, they are essentially requesting documentation that verifies the renter has an active insurance policy that covers the items stored in the unit. This requirement helps to mitigate the financial risk that the operator may face if there are any disputes or claims related to the stored belongings.

By requiring renters to have insurance, storage unit operators can also discourage individuals from storing hazardous or dangerous items. If a renter knows that their insurance policy will not cover certain items, they may be less likely to store them in the unit, reducing the risk of accidents or damages.

Options for satisfying storage unit insurance requirements

To meet the insurance requirements of a storage unit operator, renters have a few options available to them:

1. **Existing renters insurance**: If the renter already has a renters insurance policy, it is important to check if it covers items stored in a storage unit. If so, the renter can provide the storage unit operator with the necessary proof of insurance.

2. **Add storage unit coverage to existing policy**: If the renter’s current renters insurance policy does not automatically cover items stored in a storage unit, they may have the option to add this coverage as an endorsement or rider to their existing policy. This addition may come with an additional cost, but it provides the necessary coverage to satisfy the storage unit operator’s requirements.

3. **Purchase a separate storage unit insurance policy**: If the renter does not have renters insurance or their policy does not offer coverage for stored items, they can consider purchasing a separate storage unit insurance policy. These policies are specifically designed to cover the items stored in a storage unit and can be obtained from various insurance providers. It is important to carefully review the terms and coverage limits of the policy before purchasing.

4. **Dependent coverage**: In some cases, a renter may be covered under someone else’s insurance policy, such as their parent’s homeowners insurance. If this is the case, the renter can provide proof of coverage from the primary policyholder to satisfy the storage unit operator’s requirements.

Before choosing any of the above options, it is crucial for renters to thoroughly read and understand the insurance requirements of the storage unit operator. This will ensure that they select the most appropriate and cost-effective coverage option to meet the operator’s expectations.

Therefore, storage unit operators require proof of insurance to protect both the renter and themselves from any potential loss or damages. Renters can satisfy this requirement by utilizing their existing renters insurance policy, adding storage unit coverage to their policy, purchasing a separate storage unit insurance policy, or relying on dependent coverage from another policyholder. It is essential for renters to review their options and choose the most suitable coverage to comply with the storage unit operator’s requirements.

Comparison of Coverage Options

Comparison of GEICO, Nationwide, Progressive, and USAA renters insurance coverage for storage units

When it comes to renters insurance, coverage for items stored in a storage unit can vary among insurance providers. To help renters make an informed decision, let’s compare the coverage options offered by GEICO, Nationwide, Progressive, and USAA.

Key differences and similarities between policies

Here is a breakdown of the key differences and similarities in the coverage options for storage units provided by these four insurance providers:

|

Insurance Provider |

Coverage for Storage Units |

Coverage Limitations |

Additional Coverage Options |

|---|---|---|---|

|

GEICO |

GEICO offers coverage for items stored in a storage unit as part of their renters insurance policy. |

The coverage limit for stored items may vary depending on the policy. Policyholders should review their policy to understand any limitations. |

GEICO provides additional coverage options for high-value items, such as jewelry or electronics, to ensure adequate protection. |

|

Nationwide |

Nationwide also provides coverage for items stored in a storage unit as part of their renters insurance policy. |

The coverage limit for stored items is typically a percentage of the overall personal property coverage. Policyholders should check the specifics of their policy. |

Nationwide offers additional coverage options for specific high-value items, similar to GEICO. |

|

Progressive |

Progressive includes coverage for items stored in a storage unit in their renters insurance policy. |

The specific coverage limit for stored items may vary depending on the policy and is usually stated as a percentage of the overall personal property coverage. |

Progressive offers optional coverage enhancements for valuable possessions, giving policyholders the opportunity to increase protection for high-value items in storage. |

|

USAA |

USAA, like the other insurance providers, offers coverage for items stored in a storage unit with their renters insurance policy. |

The coverage limit for stored items might be limited to a certain percentage of the overall personal property coverage, depending on the policy. |

USAA provides additional coverage options for high-value items, such as jewelry or collectibles, to ensure adequate protection. |

It is important to note that these are general comparisons and the specific details of coverage and limitations can vary among policies. Renters should review the terms and conditions of each insurance policy to fully understand what is covered and what the limits are for items in storage units.

Therefore, GEICO, Nationwide, Progressive, and USAA do provide coverage for items stored in a storage unit as part of their renters insurance policies. However, the coverage limits and additional options for high-value items may vary. Renters should carefully review their policy and consider additional coverage if needed to ensure their belongings are adequately protected.

**Comparison of Coverage Options**

Comparison of GEICO, Nationwide, Progressive, and USAA renters insurance coverage for storage units

When it comes to renters insurance, coverage for items stored in a storage unit can vary among insurance providers. To help renters make an informed decision, let’s compare the coverage options offered by GEICO, Nationwide, Progressive, and USAA.

Key differences and similarities between policies

Here is a breakdown of the key differences and similarities in the coverage options for storage units provided by these four insurance providers:

| Insurance Provider | Coverage for Storage Units | Coverage Limitations | Additional Coverage Options |

|——————–|—————————|———————-|—————————-|

| GEICO | GEICO offers coverage for items stored in a storage unit as part of their renters insurance policy. | The coverage limit for stored items may vary depending on the policy. Policyholders should review their policy to understand any limitations. | GEICO provides additional coverage options for high-value items, such as jewelry or electronics, to ensure adequate protection. |

| Nationwide | Nationwide also provides coverage for items stored in a storage unit as part of their renters insurance policy. | The coverage limit for stored items is typically a percentage of the overall personal property coverage. Policyholders should check the specifics of their policy. | Nationwide offers additional coverage options for specific high-value items, similar to GEICO. |

| Progressive | Progressive includes coverage for items stored in a storage unit in their renters insurance policy. | The specific coverage limit for stored items may vary depending on the policy and is usually stated as a percentage of the overall personal property coverage. | Progressive offers optional coverage enhancements for valuable possessions, giving policyholders the opportunity to increase protection for high-value items in storage. |

| USAA | USAA, like the other insurance providers, offers coverage for items stored in a storage unit with their renters insurance policy. | The coverage limit for stored items might be limited to a certain percentage of the overall personal property coverage, depending on the policy. | USAA provides additional coverage options for high-value items, such as jewelry or collectibles, to ensure adequate protection. |

It is important to note that these are general comparisons and the specific details of coverage and limitations can vary among policies. Renters should review the terms and conditions of each insurance policy to fully understand what is covered and what the limits are for items in storage units.

Conclusion

**Summary of key points covered in the blog post:**

– Renters insurance provides coverage for items stored in a storage unit, but there are limitations.

– GEICO, Nationwide, Progressive, and USAA offer varying coverage options for storage units.

– Coverage limits for stored items can vary depending on the policy.

– Additional coverage options may be available for high-value items.

– Renters should review their policy and consider additional coverage if needed.

**Final thoughts on the importance of understanding renters insurance coverage for storage units:**

Understanding the coverage provided by renters insurance for items stored in a storage unit is essential for renters. It ensures that their belongings are adequately protected in case of theft, damage, or loss. Renters should carefully review their policy and consider any additional coverage options offered by their insurance provider to ensure that their stored items are fully protected. By doing so, renters can have peace of mind knowing that their belongings are covered in any situation.

Find out more about State farm homeowners insurance cover storage units.