Storage unit flood insurance

Importance of flood insurance for storage units

– Flooding can cause significant damage to belongings stored in self storage units

– Some people may be unaware of the potential damage that can be caused by flooding

– Taking measures to prevent flood damage in the future is crucial for protecting belongings

– Having flood insurance for storage units can provide peace of mind and financial protection

Benefits of having flood coverage

– Financial protection: Flood insurance can cover the cost of replacing or repairing belongings damaged by flooding, saving you from potential financial loss

– Peace of mind: Knowing that your belongings are covered in the event of a flood can give you peace of mind and eliminate worries about potential damage

– No need to rely on storage facility insurance: While some storage facilities may have insurance coverage, it may not always include flood damage. Having your own flood insurance ensures you have proper coverage

– Quick recovery: With flood insurance, you can quickly recover and replace your belongings in the event of a flood, minimizing downtime and disruption to your life

– Safeguard against unexpected weather events: Floods can occur unexpectedly due to severe weather conditions or natural disasters. Having flood coverage provides protection against these unforeseen events

Therefore, it is important to recognize the potential risks of flooding and take measures to protect your belongings stored in self storage units. Having flood insurance provides financial protection, peace of mind, and ensures a quick recovery in the event of a flood. Don’t wait until it’s too late – protect your items with flood coverage today.

Understanding Flood Insurance

Definition of flood insurance

Flood insurance is a type of insurance coverage specifically designed to protect against damage caused by flooding. It provides financial compensation for property damage and loss caused by flooding events, which can include heavy rains, overflowing rivers or lakes, and hurricanes or tropical storms. This coverage is typically separate from standard property insurance policies, as most policies do not include flood coverage.

Coverage options for storage units

When it comes to protecting your belongings in a storage unit from flood damage, there are a few different options to consider:

1. Standard property insurance: Most standard property insurance policies do not automatically include flood coverage. Therefore, it’s important to review your policy and discuss your flood insurance options with your insurance agent to determine if you need additional coverage.

2. Off-premises coverage: Some property insurance policies may offer limited coverage for off-premises storage units. This means that if your storage unit is located off-site, such as in a self-storage facility, you may have some level of protection against flood damage. However, this coverage is typically limited and may not provide full compensation for all losses.

3. Tenant protection plan: Many self-storage facilities offer tenant protection plans, which are additional insurance policies specifically tailored for renters of storage units. These plans can provide coverage for a range of risks, including water damage from flooding. It’s important to discuss the coverage options and limitations of these plans with the manager of your facility to ensure you have adequate protection.

4. Standalone flood insurance: If your standard property insurance policy does not provide sufficient coverage for flood damage, you may need to consider purchasing standalone flood insurance. This type of policy is specifically designed to protect against flood-related losses and can provide comprehensive coverage for both structural damage and the contents of your storage unit.

Therefore, it is important to understand the potential risks of flooding and the available options for protecting your belongings stored in a storage unit. Review your property insurance policy, discuss your coverage options with your insurance agent, and consider additional protection through a tenant protection plan or standalone flood insurance to ensure you have the coverage you need for peace of mind.

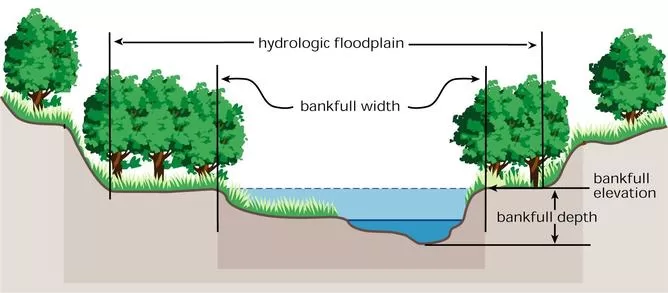

Flood Insurance for Facilities in Flood Plains

Availability of good and affordable flood insurance for facilities located in flood plains

For self-storage facilities located in flood plains, the availability of flood insurance is an important consideration. While it is true that many standard property insurance policies do not automatically include flood coverage, there are options available for businesses in flood-prone areas.

One option is to purchase a standalone flood insurance policy specifically designed to protect against flood-related losses. These policies can provide comprehensive coverage for both structural damage and the contents of the storage units. It is important for facility owners in flood plains to discuss their insurance needs with their insurance agent and explore the availability and cost of standalone flood insurance policies.

Another option is to consider joining a National Flood Insurance Program (NFIP) Community Rating System (CRS) participating community. The NFIP is a federal program that provides flood insurance to property owners in participating communities. The CRS is a program that rewards communities for taking actions to reduce flood risk and offers lower insurance premiums to participating communities. By joining a participating community and implementing flood mitigation measures, self-storage facility owners may be able to access affordable flood insurance coverage for their properties.

Cost considerations for flood insurance in flood plain areas

While the availability of flood insurance is important for facilities located in flood plains, it is also necessary to consider the potential cost of such coverage. Insurance premiums for flood insurance can vary depending on several factors, including the location of the property, the level of flood risk, and the coverage amount.

For facilities located in high-risk flood zones, the cost of flood insurance may be higher compared to properties located in low-risk zones. This is because properties in high-risk areas are more likely to experience flooding and therefore pose a higher risk to insurance providers. Facility owners should carefully assess the cost of flood insurance and consider it as part of their overall risk management strategy.

It is also worth noting that implementing flood mitigation measures can potentially reduce the cost of flood insurance. The NFIP CRS program offers premium discounts for communities that take proactive steps to reduce flood risk. By investing in flood-resistant building materials, elevating structures, and implementing floodproofing measures, facility owners may be able to qualify for lower insurance premiums.

Therefore, self-storage facilities located in flood plains should carefully consider the availability and cost of flood insurance. While most standard property insurance policies do not include flood coverage, there are options available, such as standalone flood insurance policies and participation in NFIP CRS programs. Facility owners should work with their insurance agent to assess their flood insurance needs and explore affordable coverage options. Additionally, implementing flood mitigation measures can potentially reduce the cost of insurance premiums.

Assessing Water Damage in Storage Units

Immediate actions after a flood or water damage event

After a flood or water damage event, it is important to take immediate action to minimize further damage and protect your belongings. Follow these steps:

1. Safety first: Before entering the storage unit, ensure that it is safe to do so. Check for structural damage or any potential hazards, such as electrical issues or mold growth. If there are any safety concerns, wait until it is safe to enter or seek assistance from professionals.

2. Document the damage: Take photographs or videos of the damage as evidence for insurance claims. This documentation will help in assessing the extent of the damage and filing for compensation.

3. Contact your insurance provider: Notify your insurance provider about the water damage and initiate the claim process. Provide them with all the necessary information and documentation to support your claim.

4. Remove undamaged items: If there are items that have not been affected by the water, it is advisable to remove them from the storage unit to prevent further damage. Move them to a safe and dry location while the water damage is being addressed.

Visiting the storage unit and removing contents

Once it is safe to visit the storage unit and start the restoration process, follow these steps:

1. Assess the damage: Inspect the extent of the water damage to your belongings. Determine which items can be salvaged and which are beyond repair.

2. Salvageable items: For items that can be salvaged, take immediate action to dry and clean them. Use fans, dehumidifiers, or professional drying equipment to remove moisture and prevent mold growth. Clean the items thoroughly to remove any debris or contaminants.

3. Dispose of damaged items: Unfortunately, some items may be too damaged to salvage. Dispose of these items properly and safely. Check with your local waste management authorities for guidelines on disposing of damaged belongings.

4. Address structural damage: If the storage unit has suffered structural damage, such as a compromised roof or walls, contact the facility management or owner to report the issue. They should arrange for repairs to ensure the safety and integrity of the storage unit.

Remember, the key to minimizing water damage in storage units is taking immediate action and having appropriate insurance coverage. Regularly review your insurance policy and discuss coverage options with your insurance provider to ensure you have adequate protection in case of water or flood damage.

Preparing for Future Floods

Using pallet boards, shelving, and nylon coverings for organization and protection

To minimize the risk of water damage in your storage unit during a future flood, consider the following tips:

– Utilize pallet boards: Elevating your belongings off the ground by placing them on pallet boards can help prevent direct water contact. Pallet boards create a barrier between your items and any potential floodwater, reducing the chances of damage.

– Install shelving: Adding shelves to your storage unit allows you to organize your belongings vertically, keeping them further away from the ground. This additional elevation can be beneficial in the event of a flood, as it creates more distance between your items and any potential water accumulation.

– Use nylon coverings: Invest in waterproof or water-resistant nylon coverings to wrap your belongings. These coverings can provide an extra layer of protection against water damage, helping to keep your items dry even in the event of a flood.

Discussing flood insurance options with your insurance agent

It is essential to have adequate insurance coverage for your stored belongings in case of a flood. Here are some considerations when discussing flood insurance options with your insurance agent:

– Confirm coverage: Review your insurance policy to determine if it includes coverage for water damage or flooding. If not, inquire about adding this coverage to ensure your belongings are protected.

– Evaluate coverage limits: Assess the coverage limits provided by your insurance policy. Make sure it is sufficient to cover the value of your stored items in the event of flood damage.

– Understand exclusions and deductibles: Familiarize yourself with any exclusions or deductibles associated with flood coverage. This information will help you understand the terms and conditions of your policy and potential out-of-pocket expenses in case of a flood.

– Consider additional coverage: Depending on the value of your stored items, you may want to explore options for additional coverage or higher coverage limits. Discuss this with your insurance agent to determine the best course of action for your specific needs.

By taking proactive measures such as using pallet boards, shelving, and nylon coverings for organization and protection, along with ensuring appropriate flood insurance coverage, you can be better prepared to safeguard your belongings from future flooding events. Remember to regularly assess and update your storage unit’s flood prevention measures and insurance policy to maintain adequate protection.

Coverage for Different Types of Water Damage

Coverage for flooding caused by broken pipes or roof damage

In the event of water damage caused by broken pipes or roof damage, your insurance policy may provide coverage. It is important to review your policy and understand the specifics of this coverage. Some insurance policies may cover the cost of repairing the pipes or roof, as well as any damage caused to your belongings as a result of the flooding. It is recommended to contact your insurance provider to discuss the details of your coverage and ensure you have the necessary protection.

Explanation of coverage limitations for ground or surface water

It is important to note that insurance policies typically have limitations when it comes to coverage for ground or surface water. Groundwater or surface water that enters your storage unit due to natural events, such as heavy rain or flooding, may not be covered by your standard insurance policy. This is because these types of water damage are considered to be outside of your control and are often classified as a separate insurance category, such as flood insurance. To ensure you are adequately protected in case of ground or surface water damage, it is recommended to discuss flood insurance options with your insurance agent.

When it comes to protecting your belongings from water or flood damage in your self storage unit, it is crucial to take immediate action and have appropriate insurance coverage. By following the steps outlined above and discussing your insurance options with your provider, you can have the peace of mind knowing that you are prepared for any potential water damage events. Remember to regularly review your insurance policy to ensure it meets your needs and provides adequate coverage.

Flood Insurance Requirements

When it comes to protecting your belongings from water or flood damage in your self storage unit, it is important to understand the insurance requirements and options available to you. Here are some key points to consider:

Limited coverage for enclosures below the Base Flood Elevation (BFE)

If your storage unit is located in an area prone to flooding, it is crucial to understand the limitations of your insurance coverage. Insurance policies typically have restrictions when it comes to covering enclosures below the Base Flood Elevation (BFE), which is the estimated height floodwaters could reach in a 100-year flood event. These areas are considered to be at a higher risk of flooding and may require additional flood insurance coverage.

National Flood Insurance Program requirements

The National Flood Insurance Program (NFIP) is a federal program that provides flood insurance policies to individuals and businesses. If your self storage facility is located in a Special Flood Hazard Area (SFHA), it may be mandatory for the facility to have flood insurance through the NFIP. This requirement ensures that there is adequate coverage in place to protect your belongings in the event of a flood.

It is important to check with your insurance agent and the management of your self storage facility to determine if flood insurance is required and what options are available to you. They can provide guidance on the specific requirements and help you understand the coverage limits and costs associated with flood insurance.

By understanding the flood insurance requirements and options specific to your self storage facility, you can make informed decisions to protect your belongings from potential water damage. Remember to regularly review your insurance policy to ensure it meets your needs and provides adequate coverage.

Additional Coverage Considerations

Exploring additional coverage options for self-storage units

It’s important to consider additional coverage options for your self-storage unit to protect your belongings from water or flood damage. While standard insurance policies may offer some coverage for certain types of water damage, it’s worth exploring additional options to ensure you have comprehensive protection. Here are a few coverage considerations to keep in mind:

1. Tenant Protection Plan: Many self-storage facilities offer a tenant protection plan that provides an additional level of coverage. These plans may cover water damage, including some types of flooding. Check with the manager of your facility to see if they offer such a plan and discuss the coverage options available.

2. Flood Insurance: Standard insurance policies typically have limitations when it comes to coverage for ground or surface water. To protect against floods caused by natural events like heavy rain or rising rivers, it’s recommended to explore flood insurance options. Discuss this with your insurance agent to understand the specifics of flood insurance coverage and ensure you have the necessary protection.

Factors to consider when choosing flood insurance coverage

When selecting flood insurance coverage, there are a few factors to consider to ensure you have the right protection for your needs:

1. Coverage Limitations: Review the coverage limitations of any flood insurance policy you are considering. Understand what types of water damage are covered and what may be excluded. Be aware of any deductibles, limits, or exclusions that could impact your coverage.

2. Location: Consider the location of your self-storage unit when choosing flood insurance. If the facility is in a high-risk flood zone, you may need additional coverage. Research the flood risk in the area and discuss it with your insurance agent to determine the appropriate level of coverage.

3. Valuable Belongings: If you have valuable items stored in your unit, it’s important to ensure they are adequately covered by your flood insurance. Some policies may have limitations on coverage for certain types of items, such as electronics or artwork. Review the policy’s coverage for high-value items and consider additional coverage if needed.

4. Cost: Take into account the cost of flood insurance premiums when comparing different policies. Consider the level of coverage provided, deductibles, and any additional fees associated with the policy. It’s important to find a balance between affordability and adequate coverage.

By carefully considering these factors and exploring additional coverage options, you can have peace of mind knowing that your belongings in your self-storage unit are protected from potential water or flood damage. Remember to regularly review your insurance policies to ensure they meet your needs and provide adequate coverage.

Summary of the importance of flood insurance for storage units

Flood insurance is an essential consideration for those utilizing self-storage units to protect their belongings from potential water or flood damage. While some individuals may be unaware of the risks associated with flooding or the preventative measures that can be taken, it is crucial to understand the importance of comprehensive coverage. Standard insurance policies may offer limited protection against certain types of water damage, but exploring additional coverage options ensures enhanced security. By considering factors such as tenant protection plans and flood insurance, individuals can have peace of mind knowing that their belongings are safeguarded from potential flood events.

Tips for selecting the right coverage for your specific needs

When choosing flood insurance for a self-storage unit, there are certain factors to consider to ensure appropriate protection:

1. Review coverage limitations: It is essential to thoroughly review any flood insurance policy’s coverage limitations, including what types of water damage are covered and any potential exclusions or deductibles that may impact coverage.

2. Assess location: When selecting flood insurance, evaluate the location of the self-storage unit. If the facility is situated in a high-risk flood zone, additional coverage may be necessary. Research the flood risk in the area and consult with an insurance agent to determine the appropriate level of coverage.

3. Valuable belongings: Take into account any valuable items stored in the unit and ensure they are adequately covered by flood insurance. Some policies may have limitations on coverage for items such as electronics or artwork. It is crucial to review the policy’s coverage for high-value items and consider additional coverage if needed.

4. Consider cost: When comparing different policies, factor in the cost of flood insurance premiums. Assess the level of coverage provided, deductibles, and any additional fees associated with the policy. Striking a balance between affordability and adequate coverage is important.

By carefully considering these tips and exploring additional coverage options, individuals can take proactive steps to protect their belongings from potential water or flood damage in self-storage units. Regularly reviewing insurance policies to ensure they meet specific needs and provide adequate coverage is essential for maintaining peace of mind.

Conclusion

Flood insurance is a vital consideration for individuals utilizing self-storage units. By exploring additional coverage options and selecting the right policy, individuals can ensure comprehensive protection against potential water or flood damage. Considering factors such as coverage limitations, location, valuable belongings, and cost assists in making informed decisions regarding flood insurance. By taking these proactive measures, individuals can safeguard their belongings and have peace of mind knowing that their possessions are protected from potential flood events.

Learn more about Does progressive home insurance cover storage units.