Does apartment renters insurance cover storage units

Overview of apartment renter’s insurance and its coverage

Renters insurance is an important form of coverage for individuals who live in apartments or rented homes. It provides financial protection against losses or damages to personal property, liability for injuries that occur on the rented property, and additional living expenses in case the rental becomes uninhabitable.

One common question that arises for renters is whether their insurance policy also covers property stored in a storage unit. In this blog post, we will explore the coverage limits and considerations when it comes to storing items in a storage unit.

Importance of understanding coverage for storage units

Renters who utilize storage units need to have a clear understanding of their insurance coverage to ensure that their belongings are adequately protected. While renters insurance typically covers personal property even when stored outside of the apartment, there may be specific limits or conditions that apply to storage units.

Knowing the details of your policy and any additional coverage options will help you make informed decisions about securing the right protection for your belongings in storage. Let’s delve into the topic further.

Does Renters Insurance Cover Storage Units?

One of the most common questions regarding renters insurance and storage units is whether the policy provides coverage for items stored off-premises. The answer is generally yes, as renters insurance typically extends coverage to personal property regardless of its location, including storage units.

However, it’s crucial to review your policy to understand any specific limitations or conditions that may apply to storage unit coverage. Some insurance companies may have a cap on coverage for items stored outside the premises, so it’s essential to be aware of these limits.

Coverage Limits on Storage Units

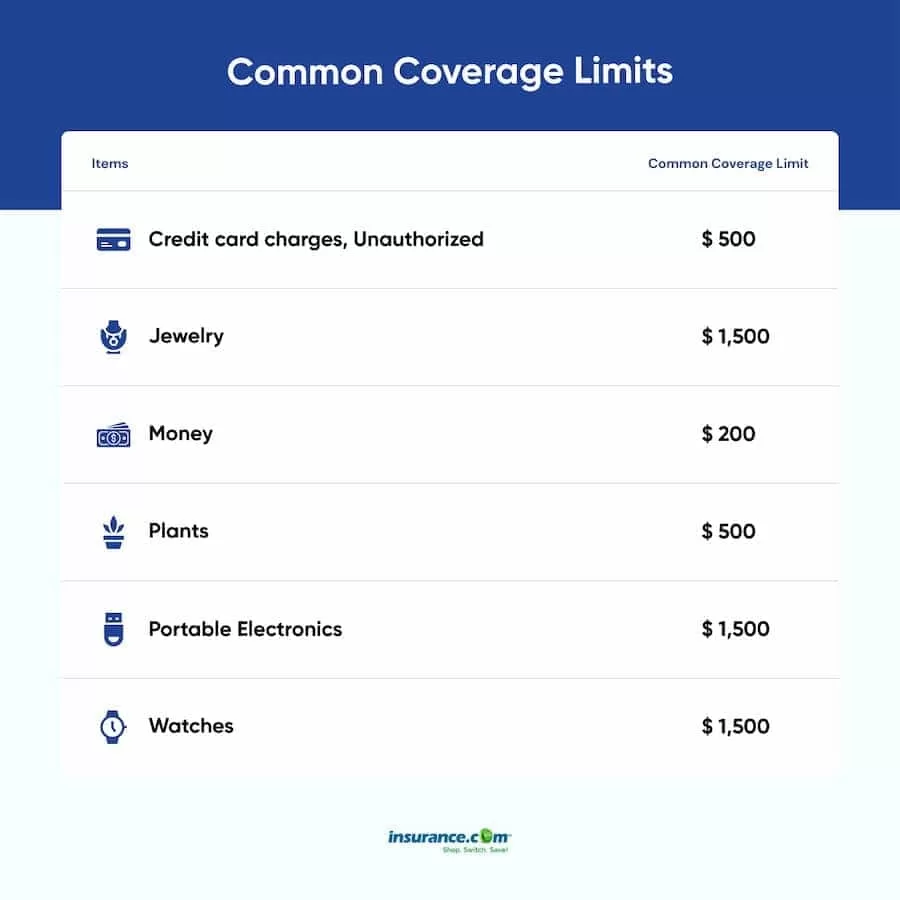

Before storing your items in a storage unit, review your renters insurance policy to determine the coverage limits that apply. While renters insurance may cover personal property in storage units, there could be a maximum limit on the amount reimbursed for losses incurred. Beyond this limit, you may need additional insurance coverage to adequately protect your belongings.

Contact your insurance provider to discuss the coverage limits for storage units and consider the value of the items you intend to store. If the coverage limit is insufficient, you may want to explore additional options for coverage.

When to Purchase Additional Renters Coverage for a Storage Unit

If your renters insurance policy does not provide adequate coverage for items stored in a storage unit, it would be prudent to consider purchasing additional insurance specifically for the stored items. This additional coverage can ensure that you are fully protected in case of damages or losses occurring to your belongings in the storage unit.

Research insurance options specifically designed for storage unit coverage and compare pricing, coverage limits, and deductibles. It is recommended to secure quotes and carefully evaluate the terms and conditions before making a decision.

Other Storage Unit Insurance Options

Apart from renters insurance, there are other insurance options available specifically for storage units. Some storage facilities offer insurance policies that can be purchased directly from them. These policies may have different coverage terms and conditions compared to renters insurance.

If you choose to purchase insurance directly from the storage facility, it is crucial to review the policy thoroughly and ensure that it provides adequate coverage for your stored items. Additionally, compare the cost and coverage limits of these storage facility insurance policies with other options available in the market.

Final Thoughts: Does Renters Insurance Cover Items in Storage Units?

Therefore, renters insurance typically extends coverage to personal property stored in a storage unit. However, it is essential to review your policy to understand any coverage limits or conditions that may apply. If your renters insurance does not provide adequate coverage for items in storage, consider purchasing additional insurance specifically for the stored belongings. Comparing pricing and coverage options will help you make an informed decision about protecting your items in a storage unit.

Understanding Renters Insurance Coverage

Explanation of typical coverage provided by renters insurance

Renters insurance is designed to protect your personal belongings from various risks, both inside and outside of your apartment. Most standard renters insurance policies provide coverage for your belongings not only within your apartment but also when they are stored in a storage unit. This means that if your belongings are damaged or stolen while in storage, your renters insurance can help reimburse you for your financial loss.

Limits and restrictions on coverage for personal belongings in storage units

While renters insurance does cover personal belongings in storage units, it is important to note that there may be limits and restrictions on this coverage. The specific coverage limits will depend on your insurance policy and provider. It is important to review your policy documents carefully to understand the extent of coverage for items stored in a storage unit.

Here are some common limitations and restrictions that can apply to coverage for personal belongings in storage units:

-

Limitations on coverage amount:

Your renters insurance policy may have a maximum coverage limit for personal belongings stored outside of your apartment. This means that if the value of your belongings stored in the storage unit exceeds the coverage limit, you may not be fully reimbursed for the loss.

-

Exclusions for certain types of property:

Some renters insurance policies may exclude coverage for certain types of valuable items or high-risk property when stored in a storage unit. It is important to check your policy to see if there are any exclusions that may apply.

-

Deductibles:

Just like with any insurance policy, renters insurance typically has a deductible. This is the amount you are responsible for paying before your insurance coverage kicks in. Make sure to consider your deductible when calculating the potential reimbursement for a loss in your storage unit.

It is also worth noting that while renters insurance covers damage or theft of personal belongings in a storage unit, it may not cover damage caused by natural disasters such as floods or earthquakes. If you live in an area prone to these types of events, you may want to consider purchasing additional insurance coverage specifically for these risks.

Overall, renters insurance can provide valuable protection for your personal belongings, even when they are stored in a storage unit. However, it is important to be aware of any limitations and restrictions on coverage and consider additional insurance options if necessary. Reviewing your policy documents and discussing your needs with an insurance professional can help ensure that you have the right coverage in place.

Personal Property Coverage

Coverage provided for personal belongings in storage units

Renters insurance offers coverage for personal belongings stored in a storage unit, in addition to providing protection for items within your apartment. This means that if your stored belongings are damaged or stolen, your renters insurance can help you recover financially.

Determining the maximum coverage limit for stored items

While renters insurance covers items in storage units, there may be limits on the coverage amount. The maximum coverage limit for stored items will depend on your specific insurance policy and provider. It’s important to carefully review your policy documents to understand the extent of coverage for items stored in a storage unit.

Here are some key factors to consider regarding coverage limits for stored items:

– **Limitations on coverage amount:** Your renters insurance policy may have a maximum coverage limit for personal belongings stored outside of your apartment. If the value of your stored belongings exceeds this limit, you may not be fully reimbursed for any loss.

– **Exclusions for certain types of property:** Some renters insurance policies may exclude coverage for certain high-value or high-risk items when they are stored in a storage unit. It’s crucial to check your policy documents to see if there are any exclusions that apply to your stored items.

– **Deductibles:** Renters insurance typically includes a deductible, which is the amount you must pay out of pocket before your insurance coverage starts. It’s essential to consider your deductible when calculating potential reimbursement for a loss in your storage unit.

Additionally, it’s worth noting that while renters insurance covers damage or theft of personal belongings in a storage unit, it may not cover damage caused by natural disasters such as floods or earthquakes. If you reside in an area prone to these events, it may be wise to consider purchasing additional insurance coverage specifically for these risks.

Overall, renters insurance provides valuable protection for personal belongings, even when they are stored in a storage unit. However, it’s crucial to be aware of any limitations and restrictions on coverage and explore additional insurance options if necessary. carefully review your policy documents and consult with an insurance professional to ensure that you have the appropriate coverage in place.

Additional Coverage Options

Exploring options for additional coverage for belongings in storage units

While renters insurance does provide coverage for personal belongings in storage units, you may want to consider additional coverage options for added protection. Here are some options to explore:

1. Storage Unit Insurance: Some storage facilities offer their own insurance policies that you can purchase specifically for your storage unit. These policies are designed to cover the value of your belongings in case of damage or theft while they are stored. It’s important to review the terms and conditions of the storage unit insurance policy to understand the coverage limits and any exclusions.

2. Floater Policy: A floater policy is an additional insurance policy that provides coverage for specific high-value items, such as jewelry, fine art, or collectibles. If you have valuable items stored in your storage unit, a floater policy can provide extra coverage and protection beyond what is included in your renters insurance policy.

3. Umbrella Policy: An umbrella policy is a type of insurance that provides additional liability coverage beyond the limits of your renters insurance. While this may not directly cover your belongings in a storage unit, it can provide financial protection in case of legal issues or personal injury claims that arise from incidents related to your storage unit.

Benefits and considerations of purchasing additional coverage

There are several benefits and considerations to keep in mind when deciding whether to purchase additional coverage for your belongings in a storage unit:

1. Enhanced Protection: Additional coverage options can provide extra protection for your valuable items or for scenarios not covered by your renters insurance. This can give you peace of mind knowing that you have sufficient coverage for your stored belongings.

2. Coverage Limits: It’s important to understand the coverage limits of your renters insurance policy and any additional coverage options. Make sure the coverage amount is sufficient to cover the value of your stored belongings.

3. Cost: Additional coverage options may come at an additional cost. Consider whether the added protection and peace of mind outweigh the cost of the premiums for these policies.

4. Policy Terms and Conditions: Carefully review the terms and conditions of any additional coverage options to understand what is covered, any exclusions, and the claims process. Make sure the policy aligns with your specific needs and requirements.

5. Consultation with an Insurance Professional: If you have questions or concerns about your coverage options, it’s always a good idea to consult with an insurance professional. They can help assess your needs, explain policy details, and guide you towards the right coverage options for your situation.

Therefore, while renters insurance does cover personal belongings in storage units, it’s important to be aware of any limitations or restrictions that may apply. Consider purchasing additional coverage options such as storage unit insurance, floater policies, or umbrella policies for enhanced protection and peace of mind. Review the terms and conditions of these policies and consult with an insurance professional to ensure you have the right coverage in place for your stored belongings.

Renters Insurance Policies

Reviewing different renter’s insurance policies and their coverage for storage units

When it comes to storing your personal belongings in a storage unit, it’s important to understand the coverage provided by your renters insurance policy. Most renters insurance policies do cover items stored in storage units, as they typically offer personal property coverage that reimburses you for financial loss if your property is damaged. However, it’s important to review the specifics of your policy to ensure your belongings are adequately protected.

Some key considerations when reviewing different renter’s insurance policies for storage units include:

– Coverage for personal property: Check if your policy explicitly states coverage for personal property stored outside of your apartment, including storage units. Make sure there are no restrictions or limitations on the types of items covered.

– Coverage limits: Review the coverage limits of your renters insurance policy to ensure it is sufficient to cover the value of your stored belongings. If you have high-value items, you may need to consider additional coverage options.

– Deductibles: Take note of the deductible amount specified in your renters insurance policy. In the event of a claim, you will be responsible for paying this amount before the insurance coverage kicks in.

Comparing coverage limits and premiums

When comparing different renters insurance policies for storage units, it’s essential to consider the coverage limits and premiums offered by each policy. Here are some factors to consider:

– Coverage limits: Different policies may have varying coverage limits for personal property stored in storage units. Ensure that the coverage limits are sufficient to protect the value of your belongings.

– Premiums: Compare the premiums of different policies to find a balance between coverage and cost. Keep in mind that lower premiums may come with lower coverage limits, so it’s important to strike the right balance.

– Additional coverage options: Some renters insurance policies may offer optional add-ons or endorsements that provide additional coverage for items in storage units. These additional coverage options usually come at an additional cost, so assess whether the added protection is worth the increased premium.

Comparing different renters insurance policies can help you find the right coverage for your stored belongings. It’s important to understand your policy’s coverage for storage units, including any limitations or exclusions. Additionally, reviewing the coverage limits, deductibles, and premiums of different policies can help you make an informed decision.

Remember, if you have any questions or concerns about your renters insurance coverage for storage units, it’s always a good idea to consult with an insurance professional. They can provide guidance tailored to your specific needs and help you select the best policy to protect your stored belongings.

Claims Process

Step-by-step guide to filing a claim for damages or loss of items in storage

Filing a claim for damages or loss of items in a storage unit can be a stressful situation. Here is a step-by-step guide to help you navigate the claims process:

1. Document the Damage: Start by documenting the damage or loss in detail. Take photographs or videos of the affected items and make a list of the damaged or missing belongings. This documentation will be important evidence when filing a claim.

2. Review Your Insurance Policy: Carefully review your renters insurance policy or any additional coverage options you have purchased for your stored belongings. Understand the coverage limits and any applicable deductibles.

3. Contact Your Insurance Provider: Contact your insurance provider as soon as possible to report the damage or loss. They will guide you through the claims process and provide you with the necessary forms and documentation requirements.

4. File a Police Report: If the damage or loss is due to theft or vandalism, it is important to file a police report. Provide the police report number to your insurance provider as it may be required for your claim.

5. Complete the Claim Forms: Fill out the claim forms provided by your insurance provider accurately and completely. Include all necessary information, such as the date and description of the incident, the value of the damaged or missing items, and any supporting documentation.

6. Provide Supporting Documentation: Gather any supporting documentation requested by your insurance provider, such as receipts, appraisals, or proof of ownership for the damaged or missing items. This evidence will help substantiate your claim.

7. Submit the Claim: Submit the completed claim forms and supporting documentation to your insurance provider within the specified time frame. Keep copies of all documents for your records.

8. Cooperate with the Claims Adjuster: Your insurance provider may assign a claims adjuster to evaluate the extent of the damage or loss. Cooperate with the adjuster and provide any additional information they request to expedite the claims process.

9. Follow Up: Stay in contact with your insurance provider throughout the claims process. Follow up on the status of your claim and provide any additional information or documentation that may be required.

Understanding the documentation and evidence required

When filing a claim for damages or loss of items in storage, there are certain documentation and evidence that are typically required by insurance providers. These may include:

1. Proof of Ownership: Provide documentation that proves you are the rightful owner of the damaged or missing items. This can include receipts, invoices, or photographs that show you owned the items prior to the incident.

2. Appraisals or Valuations: If you have high-value items, such as jewelry or artwork, it may be necessary to provide appraisals or valuations to establish their worth.

3. Police Reports: If the damage or loss is a result of theft or vandalism, a police report is often required as evidence.

4. Repair or Replacement Estimates: Obtain estimates for the repair or replacement of damaged items. These estimates can help determine the cost of the claim.

5. Photographs or Videos: Visual evidence, such as photographs or videos of the damaged items, can help support your claim.

It is important to carefully review your insurance policy and consult with your insurance provider to ensure you provide all the necessary documentation and evidence for your claim. By following the claims process diligently and providing the required documentation, you can increase the likelihood of a successful claim settlement.

Tips for Protecting Stored Belongings

Guidelines for protecting personal belongings in storage units

Protecting your stored belongings is crucial to ensure their safety and minimize the risk of damage or theft. Here are some guidelines to help you protect your belongings in storage units:

1. Choose a Secure Facility: Before selecting a storage facility, ensure that it has proper security measures in place. Look for facilities with features like surveillance cameras, gated access, and on-site security personnel.

2. Use High-Quality Locks: Invest in high-quality locks to secure your storage unit. Avoid using padlocks that can be easily cut or picked. Consider using disc locks or cylinder locks for added security.

3. Utilize Climate Control: If you are storing items that are sensitive to temperature and humidity changes, opt for a storage unit with climate control. This will help protect your belongings from extreme temperatures, moisture, and mold.

4. Properly Package and Label Items: When packing your belongings for storage, use sturdy boxes, packing materials, and bubble wrap to protect fragile items. Label each box clearly with its contents to make it easier to find specific items later.

5. Stack and Organize: Maximize the space in your storage unit by stacking boxes and furniture securely. Place heavier items at the bottom and lighter items on top. Leave aisles for easy access to your belongings.

6. Elevate Items off the Floor: To prevent water damage, elevate your belongings off the floor using pallets or shelves. This will provide protection in case of any leaks or flooding.

7. Consider Insurance Coverage: While renters insurance typically covers items in storage units, it’s a good idea to review your policy and consider additional coverage if needed. This will provide extra protection and peace of mind.

Preventive measures to reduce the risk of damage or theft

Taking preventive measures can significantly reduce the risk of damage or theft of your stored belongings. Here are some steps you can take:

1. Conduct Regular Inspections: Visit your storage unit regularly to check for any signs of damage, leaks, or pests. Promptly report any issues to the storage facility management.

2. Maintain Adequate Insurance Coverage: Review your insurance coverage periodically to ensure it is sufficient to protect the value of your stored belongings. Consider increasing coverage if you have valuable or high-ticket items.

3. Don’t Store Hazardous Materials: Avoid storing flammable, combustible, or hazardous materials in your storage unit. These items can pose a safety risk and may violate storage facility policies.

4. Don’t Advertise Valuables: Avoid leaving any visible signs of valuable items in plain view. Keep your belongings discreetly packed and avoid using boxes that indicate valuable contents.

5. Share Storage Unit Information Selectively: Limit the number of people you share information about your storage unit with. Only provide access to trusted individuals and avoid sharing your access code or key with unauthorized parties.

By following these guidelines and taking preventive measures, you can help ensure the safety and security of your stored belongings. Remember to always consult your insurance provider and storage facility for specific guidelines and requirements.

Common Misconceptions

Addressing common misconceptions about renters insurance and coverage for storage units

There are some common misconceptions surrounding renters insurance and coverage for storage units. Let’s address a few of them to provide clarification:

1. Myth: Renters insurance does not cover items in storage units.

– Fact: Renters insurance typically does cover items stored in a storage unit. The coverage for personal property extends to items stored outside of the apartment. However, there may be limitations and coverage limits in place, so it’s important to review your policy.

2. Myth: Homeowners insurance does not cover storage units.

– Fact: Homeowners insurance also typically covers items stored in a storage unit. Just like with renters insurance, it’s important to review your policy to understand the extent of coverage and any limitations.

3. Myth: Renters insurance provides unlimited coverage for storage units.

– Fact: Renters insurance policies have coverage limits for items stored in a storage unit. It’s essential to review your policy to know the maximum amount of coverage provided for stored belongings. If your items exceed this limit, you may need to consider purchasing additional coverage.

4. Myth: Storage unit insurance is not necessary if you have renters insurance.

– Fact: While renters insurance can cover items stored in a storage unit, it’s essential to assess the value of the items and the coverage limits of your policy. If the value of your stored belongings exceeds the coverage limit, it may be wise to consider additional storage unit insurance.

Clarifying myths and misconceptions surrounding storage unit coverage

Let’s further clarify some of the misconceptions surrounding storage unit coverage under renters insurance:

1. Coverage Limits on Storage Units:

– Renters insurance policies typically have coverage limits for stored belongings. These limits vary depending on the policy and the insurance provider. It’s crucial to understand these limits to ensure your stored items are adequately protected.

2. When to Purchase Additional Renters Coverage for a Storage Unit:

– If the value of your stored items exceeds the coverage limits of your renters insurance policy, it may be necessary to purchase additional coverage specifically for the storage unit. This will ensure that your high-value possessions are fully protected.

3. Other Storage Unit Insurance Options:

– In addition to renters insurance, there are other insurance options available specifically designed for storage units. These storage unit insurance policies provide coverage beyond the limits of renters insurance and may be worth considering for added protection.

Therefore, renters insurance generally covers items stored in a storage unit, but there may be limitations and coverage limits to consider. It’s important to carefully review your policy, understand the coverage limits, and assess the value of your stored belongings. If needed, additional coverage options can be explored to ensure comprehensive protection for your stored items.

Final Thoughts

Recap of key points regarding renters insurance coverage for storage units

To recap, here are the key points to remember about renters insurance coverage for storage units:

1. Renters insurance typically covers items stored in a storage unit. It extends coverage for personal property even when stored outside of the apartment.

2. Homeowners insurance also provides coverage for storage units, similar to renters insurance.

3. Renters insurance and homeowners insurance may have coverage limits for stored belongings. It’s important to review your policy to understand these limits.

4. If the value of your stored items exceeds the coverage limit of your renters insurance policy, consider purchasing additional coverage for the storage unit to ensure adequate protection.

5. There are other insurance options available specifically for storage units, which provide coverage beyond the limits of renters insurance.

Importance of reviewing and updating insurance policies regularly

It is crucial to regularly review and update your insurance policies, including renters insurance and homeowners insurance, to ensure that your coverage aligns with your needs. This is especially important when it comes to covering items in storage units.

Here are a few reasons why reviewing and updating your insurance policies is important:

1. Coverage limits may change: Insurance policies may have coverage limits that can change over time. It’s important to stay informed about these limits to ensure that your stored items are adequately protected.

2. Changes in property value: Property values can fluctuate, and the value of your stored belongings may increase over time. It’s essential to reassess the value of your possessions regularly and update your coverage if needed.

3. Acquiring new high-value items: If you acquire new high-value items that you plan to store in a storage unit, it’s important to update your insurance policy accordingly. This will ensure that these items are adequately protected in case of damage or loss.

4. Changes in storage unit usage: If you change the way you use your storage unit or if you start storing more valuable items, it’s important to review your coverage and consider additional insurance options if necessary.

By regularly reviewing and updating your insurance policies, you can ensure that your stored belongings are adequately protected and avoid any potential gaps in coverage.

Therefore, renters insurance generally covers items stored in a storage unit, but it’s important to review your policy, understand the coverage limits, and assess the value of your stored belongings. If needed, additional insurance options can be explored to ensure comprehensive protection for your stored items. Remember to regularly review and update your insurance policies to align with your changing needs.

Explore Insurance coverage for storage units.