Introduction to Storage Insurance

What is storage insurance?

Storage insurance is a specialized insurance product that provides coverage for personal and business items that are stored away from home. It offers protection against risks such as fire, theft, and other potential damages that may occur while the items are in storage. Whether you are storing your belongings in a self-storage facility or using external storage options, having storage insurance ensures that you are financially protected in case of any unfortunate events.

Importance of storage insurance for protecting belongings

Protecting your belongings is of utmost importance, especially when they are stored away from home. Here are some reasons why storage insurance is essential for safeguarding your belongings:

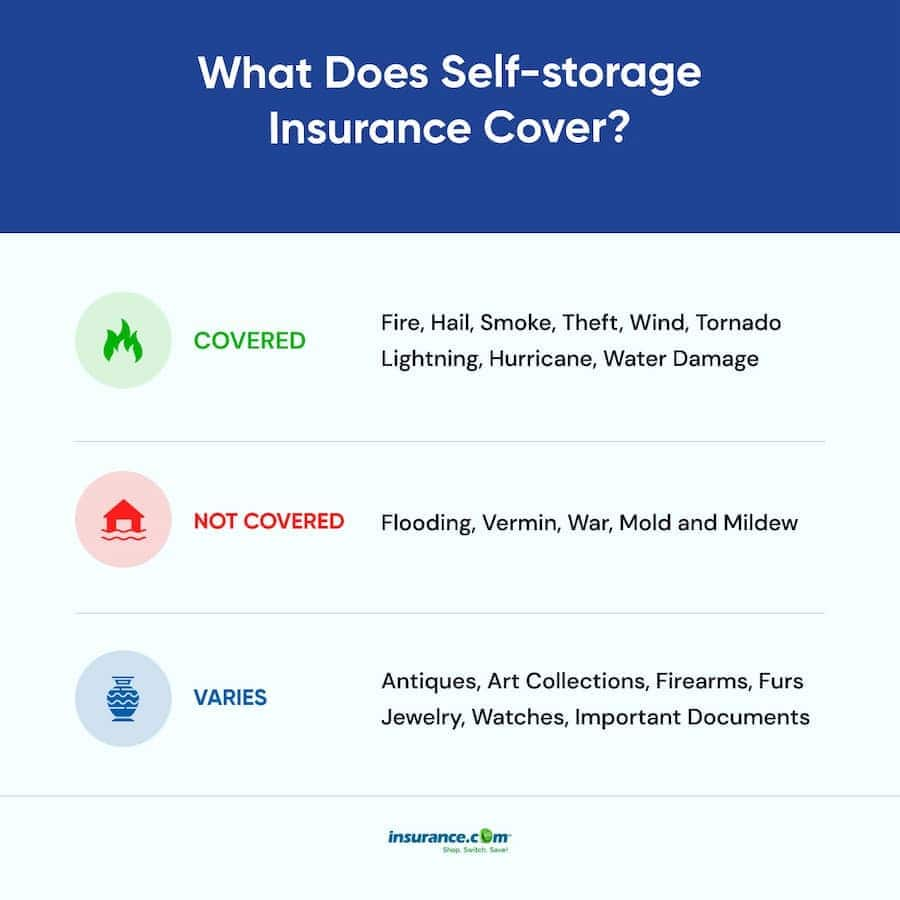

1. Coverage against risks: Storage insurance provides coverage against a range of risks that can potentially damage your items. This includes protection against fire, theft, vandalism, natural disasters like floods and storms, and other unforeseen accidents. Having insurance ensures that you don’t have to bear the financial burden of replacing or repairing your belongings in case of any damage or loss.

2. Compulsory requirement: In many self-storage facilities, having storage insurance is a compulsory requirement. This means that without insurance, you may not be allowed to rent a storage unit. It is important to check with the storage facility about their insurance requirements before storing your items.

3. Cost-effective option: While some storage providers offer insurance options, they are often more expensive compared to standalone storage insurance policies. By opting for specialized storage insurance, you can potentially save money and get better coverage tailored specifically for your storage needs.

4. Immediate coverage: Instant insurance certificates are provided when you purchase storage insurance, giving you immediate proof of coverage. This ensures that your belongings are protected from the moment you start storing them.

5. Wide-ranging coverage: Storage insurance offers comprehensive coverage for both external and internal storage types. Whether you are using a self-storage unit, container storage, or any other storage option, storage insurance will provide the necessary protection for your belongings.

6. Goods in transit cover: Many storage insurance policies also include coverage for goods in transit. This can be beneficial if you need to transport your belongings from one location to another. Having this additional coverage ensures that your items are protected throughout the entire storage process.

It is important to understand the terms and conditions of your storage insurance policy to ensure that you are adequately covered for your specific storage needs. By having storage insurance, you can have peace of mind knowing that your belongings are protected, allowing you to focus on other aspects of your life or business.

Understanding Storage Unit Requirements

Why storage units in the UK require insurance

In the UK, it is a common requirement for storage facilities to have insurance in place for the protection of their customers’ belongings. This is because storage units can be vulnerable to risks such as fire, theft, and damage. By having insurance coverage, both the storage facility and the customer can have peace of mind knowing that their items are protected.

Benefits of having a dedicated storage insurance policy

While many storage providers offer insurance options, it is important to consider the benefits of having a dedicated storage insurance policy. These policies are specifically tailored to cover the unique risks associated with storing belongings in a storage unit. Here are some advantages of having a dedicated storage insurance policy:

1. Cost-effective: Storage insurance policies that are specifically designed for storage units often offer more cost-effective coverage compared to the insurance options provided by storage facilities. This can save customers from being charged excessive premiums for insurance coverage.

2. Comprehensive coverage: Dedicated storage insurance policies typically offer comprehensive coverage against risks such as fire, theft, water damage, and natural disasters. This means that customers can have peace of mind knowing that their belongings are protected in various scenarios.

3. Flexibility: With a dedicated storage insurance policy, customers have the flexibility to choose the amount of coverage they need based on the value of their stored items. This allows them to customize their insurance policy to meet their specific requirements.

4. Faster claims process: Storage insurance policies often come with a more streamlined and efficient claims process. This means that in the unfortunate event of a loss or damage to stored items, customers can expect a quicker resolution and reimbursement.

5. Additional benefits: Some dedicated storage insurance policies may come with additional perks such as coverage for removal and relocation costs, temporary storage during renovations, and protection against damage caused by pests or mold.

Therefore, it is important to understand the storage unit requirements in the UK and the benefits of having a dedicated storage insurance policy. By ensuring that your stored items are adequately protected, you can have peace of mind and avoid potentially high insurance costs charged by storage facilities. Consider exploring dedicated storage insurance options that offer cost-effective, comprehensive coverage to protect your belongings.

Coverage and Cost

Factors affecting storage insurance rates

The cost of storage insurance can vary depending on several factors. These factors may include:

– Location: Storage facilities in certain areas may be at a higher risk of theft or natural disasters, resulting in higher insurance rates.

– Value of items: The higher the value of the items stored in the unit, the higher the insurance premium may be.

– Security measures: Storage facilities with advanced security features, such as CCTV cameras and access control systems, may offer lower insurance rates.

– Insurance coverage limits: The extent of coverage offered by the insurance policy can also impact the cost. Higher coverage limits may lead to higher premiums.

Pricing and cost-saving options

While storage insurance is a necessary expense, there are ways to save on costs:

– Compare quotes: Shopping around and comparing quotes from different insurance providers can help find the most affordable option.

– Bundle policies: Some insurance companies offer discounts for bundling storage insurance with other types of insurance, such as home or auto insurance.

– Increase security: Investing in additional security measures for the storage unit, such as a secure lock or an alarm system, may help reduce insurance costs.

– Opt for higher deductibles: Choosing a higher deductible can lower insurance premiums. However, it’s essential to ensure that the deductible is still affordable in the event of a claim.

By considering these factors and cost-saving options, individuals can find affordable storage insurance that provides adequate coverage for their stored belongings.

Conclusion

Having dedicated storage insurance in place is essential for protecting the contents of your storage unit. While storage facilities may offer insurance options, dedicated storage insurance policies provide cost-effective coverage tailored to the unique risks associated with storage units. By understanding storage unit requirements and considering the benefits of dedicated storage insurance, individuals can make informed decisions and ensure their belongings are adequately protected. It is recommended to shop around, compare quotes, and explore cost-saving options to find the most affordable and comprehensive storage insurance policy.

Immediate Coverage and Benefits

Immediate coverage from the moment items leave your home

When it comes to protecting your belongings in a storage unit, having immediate coverage is crucial. With a dedicated storage insurance policy, you can enjoy immediate coverage from the moment your items leave your home. This means that as soon as your belongings are in transit or stored in a storage facility, they are protected against risks such as fire, theft, and damage.

No fees, no excess, and certificate of storage insurance

Unlike some storage insurance options offered by storage facilities, a dedicated storage insurance policy often comes with no fees and no excess. This means that you won’t have to worry about any additional costs or deductibles when it comes to making a claim. Additionally, with a dedicated storage insurance policy, you will receive a certificate of storage insurance that provides confirmation of your coverage. This certificate can be handy for both personal and business purposes, providing proof of insurance when needed.

Understanding Storage Unit Requirements

Why storage units in the UK require insurance

In the UK, it is a common requirement for storage facilities to have insurance in place for the protection of their customers’ belongings. This is because storage units can be vulnerable to risks such as fire, theft, and damage. By having insurance coverage, both the storage facility and the customer can have peace of mind knowing that their items are protected.

Benefits of having a dedicated storage insurance policy

While many storage providers offer insurance options, there are several benefits to having a dedicated storage insurance policy:

-

Cost-effective: Storage insurance policies that are specifically designed for storage units often offer more cost-effective coverage compared to the insurance options provided by storage facilities.

-

Comprehensive coverage: Dedicated storage insurance policies typically offer comprehensive coverage against risks such as fire, theft, water damage, and natural disasters.

-

Flexibility: With a dedicated storage insurance policy, customers have the flexibility to choose the amount of coverage they need based on the value of their stored items.

-

Faster claims process: Storage insurance policies often come with a more streamlined and efficient claims process, ensuring a quicker resolution and reimbursement in the event of a loss or damage.

-

Additional benefits: Some dedicated storage insurance policies may come with additional perks such as coverage for removal and relocation costs, temporary storage during renovations, and protection against damage caused by pests or mold.

By understanding the storage unit requirements in the UK and the benefits of having a dedicated storage insurance policy, you can ensure that your stored items are adequately protected. This not only provides peace of mind but also saves you from potentially high insurance costs charged by storage facilities. Consider exploring dedicated storage insurance options that offer cost-effective, comprehensive coverage to protect your belongings.

Types of Coverage

Protection against fire, theft, and other risks

When it comes to storing your belongings in a storage unit, it’s important to have insurance coverage that offers protection against various risks. A dedicated storage insurance policy provides coverage for risks such as fire, theft, and other potential damages. This means that if your stored items are affected by a fire or are stolen, you can rest assured knowing that you’ll be reimbursed for the value of your items.

Comprehensive coverage for valuable items

A dedicated storage insurance policy also offers comprehensive coverage for your valuable items. Whether you’re storing personal possessions or business assets, a dedicated storage insurance policy can provide coverage for a wide range of risks. This includes coverage for water damage, natural disasters, and other unforeseen events. With this comprehensive coverage, you can have peace of mind knowing that your valuable items are protected against any potential damages.

By opting for a dedicated storage insurance policy, you can have the reassurance of immediate coverage, no additional fees or excess costs, and a certificate of insurance. Additionally, you’ll benefit from cost-effective coverage, comprehensive protection, flexibility in choosing the amount of coverage you need, a faster claims process, and potentially additional benefits such as coverage for removal and relocation costs or protection against damage caused by pests or mold.

It is important to note that while some storage facilities may offer insurance options, a dedicated storage insurance policy generally offers more cost-effective and comprehensive coverage. By understanding the requirements of storage facilities in the UK and the benefits of a dedicated storage insurance policy, you can make an informed decision to adequately protect your stored belongings without incurring high insurance costs.

To ensure the safety and protection of your stored items, it is advisable to explore dedicated storage insurance options that offer immediate coverage and comprehensive protection against risks such as fire, theft, and other damages. With the right insurance coverage, you can have peace of mind knowing that your stored items are fully protected, allowing you to focus on other important aspects of your life or business.

Choosing the Right Storage Insurance Policy

Factors to consider when choosing a storage insurance policy

When selecting a storage insurance provider, there are several important factors to consider:

-

Immediate coverage and benefits: Look for a policy that offers immediate coverage from the moment your items leave your home. This ensures that your belongings are protected against risks such as fire, theft, and damage.

-

Price: While price shouldn’t be the sole determining factor, it is important to ensure that the cost of the policy is proportionate to the value of the items you are storing. The cheapest option may not always provide the best coverage.

-

Storage unit requirements: In the UK, it is a common requirement for storage facilities to have insurance in place for the protection of their customers’ belongings. Make sure the policy you choose meets these requirements.

-

Comprehensive coverage: Consider the level of coverage the policy offers. Look for options that provide comprehensive coverage against risks such as fire, theft, water damage, and natural disasters.

-

Flexibility: Choose a policy that allows you to customize the coverage based on the value of your stored items. This ensures that you are not paying for coverage that you don’t need.

-

Claims process: Look for a policy that has a fast and streamlined claims process. This ensures that in the event of a loss or damage, you can quickly resolve the issue and get reimbursement.

-

Additional benefits: Some storage insurance policies may offer additional benefits such as coverage for removal and relocation costs, temporary storage during renovations, or protection against damage caused by pests or mold. Consider if these perks align with your needs.

Comparison of available storage insurance policies

To help you make an informed decision, here’s a comparison of some popular storage insurance policies:

|

Insurance Provider |

Immediate Coverage |

Price |

Comprehensive Coverage |

Flexibility |

Claims Process |

Additional Benefits |

|---|---|---|---|---|---|---|

|

Provider A |

Yes |

Competitive |

Yes |

Yes |

Streamlined |

Yes |

|

Provider B |

Yes |

Lowest price |

Limited |

Limited |

Standard |

No |

|

Provider C |

Yes |

High-end |

Extensive |

Yes |

Efficient |

Yes |

Remember, choosing a dedicated storage insurance provider ensures that you get the best, most appropriate cover for the risks involved in storing your belongings. Consider the factors mentioned above and compare different policies to find the one that suits your needs and provides the necessary protection for your stored items.

Claims and Policy Details

Procedures for making a claim

If you experience an incident that may result in a claim, it is important to follow the necessary procedures to ensure a smooth claims process. Here are the steps you should take:

-

Contact your storage insurance provider immediately to report the incident. Make sure to provide all relevant details, including the nature of the incident, the extent of damage or loss, and any supporting documentation.

-

If required, complete any claim forms provided by the insurance company. Provide accurate and detailed information to expedite the claims process.

-

Take photos or videos of the damaged or lost items as evidence for your claim.

-

Cooperate fully with the insurance company’s investigation, providing any requested information or documentation.

-

Keep copies of all correspondence with the insurance company related to your claim for future reference.

-

Follow any additional instructions or requirements provided by the insurance company to ensure a successful claim.

-

Keep a record of any expenses you incur as a result of the incident, as these may be eligible for reimbursement under your policy.

Policy details and terms to be aware of

When taking out a storage insurance policy, it is important to familiarize yourself with the terms and conditions of the policy. Here are some key details to be aware of:

-

Sum assured: Ensure that the minimum sum assured provided by the policy meets your coverage needs. You may need to increase the sum assured for higher-value stored items.

-

Coverage period: Check the duration of the policy and ensure it aligns with your storage needs. Policies are typically available for one to twelve months.

-

Exclusions: Review the policy exclusions to understand what risks and circumstances are not covered. Exclusions may include damage caused by natural disasters, war, or certain types of negligence.

-

Policy limits: Some policies may have item-specific coverage limits or a maximum overall coverage limit. Make sure these limits meet your requirements.

-

Premiums and payment terms: Understand the premium amount and frequency of payments. Consider if the payment schedule aligns with your budget and preferences.

-

Cancellation policy: Familiarize yourself with the policy’s cancellation terms and any applicable fees or penalties.

By understanding the claims process and the key details of your storage insurance policy, you can ensure that you are fully prepared in the event of a claim and achieve the best outcome for your stored items. Be proactive in reviewing your policy and make any necessary updates or adjustments to maintain adequate coverage throughout the storage period.

Storage Insurance FAQs

Commonly asked questions about storage insurance

If you’re considering getting storage insurance for your belongings, you may have some questions in mind. Here, we answer some of the most commonly asked questions about storage insurance:

Providing answers and clarification

1. What exactly is storage insurance?

Storage insurance is a type of coverage that protects the contents of your storage unit from risks such as fire, theft, and damage. It ensures that in the event of any unforeseen circumstances, you are financially protected.

2. Why do I need storage insurance?

While storage insurance may not be a legal requirement, many storage facilities have it as a mandatory policy to protect their customers’ belongings. Without storage insurance, you may be solely responsible for any loss or damage to your stored items.

3. How does storage insurance work?

When you purchase a storage insurance policy, you pay a premium either monthly or annually. In return, the insurance provider covers any eligible claims up to the policy’s coverage limit. It is essential to read the policy terms and conditions to understand the coverage details.

4. What risks does storage insurance cover?

Most storage insurance policies cover risks such as fire, theft, water damage, natural disasters, and damage caused by pests or mold. However, the coverage may vary depending on the policy and provider, so it’s essential to review the policy details before committing.

5. How much does storage insurance cost?

The cost of storage insurance can vary depending on several factors, including the value of the items you are storing, the level of coverage you choose, and the insurance provider. It’s advisable to compare different policies to find one that offers good coverage at a reasonable price.

6. Can I customize my storage insurance coverage?

Yes, many storage insurance policies allow you to customize your coverage based on the value of your stored items. This ensures that you are not overpaying for coverage that you don’t need.

7. How do I file a claim?

In the event of loss or damage to your stored items, contact your insurance provider as soon as possible to begin the claims process. Most providers have a straightforward claims process that involves providing documentation, such as proof of ownership and evidence of the loss or damage.

8. Are there any additional benefits that storage insurance policies may offer?

Some storage insurance policies may offer additional benefits such as coverage for removal and relocation costs, temporary storage during renovations, or protection against damage caused by pests or mold. These additional perks can provide added peace of mind for specific situations.

Remember, when choosing a storage insurance policy, always consider factors such as immediate coverage, price, comprehensive coverage, flexibility, claims process, and additional benefits. Compare different policies to find the one that suits your needs and provides the necessary protection for your stored items.

Conclusion

Recap of the importance and benefits of storage insurance

Therefore, storage insurance is a vital safeguard for your belongings when utilizing self-storage facilities. While not legally required, it offers peace of mind and financial protection against risks such as fire, theft, and damage. By having storage insurance, you can mitigate the potential financial burden of replacing or repairing your stored items in the event of unforeseen circumstances.

The benefits of storage insurance include:

– Coverage for risks such as fire, theft, water damage, natural disasters, and damage caused by pests or mold.

– Customizable coverage options based on the value of your stored items, ensuring that you pay for the protection you require.

– Additional perks like coverage for removal and relocation costs, temporary storage during renovations, or protection against damage caused by pests or mold.

Final thoughts and recommendations for obtaining the right coverage

When considering storage insurance, it is important to carefully review and compare different policies to find the one that best suits your needs. Here are some recommendations for obtaining the right coverage:

1. Evaluate the immediate coverage provided by the insurance policy to ensure you are protected from day one.

2. Consider the cost of the insurance premium in relation to the value of your stored items. Compare prices and coverage levels from different insurance providers to find one that offers good value for money.

3. Take into account the comprehensiveness of the coverage provided. Look for policies that cover a wide range of risks and offer flexibility to customize your coverage.

4. Assess the claims process of each insurance provider. Look for one with a straightforward and efficient claims process, as this can significantly impact your experience during a claim.

5. Consider any additional benefits offered by the insurance policy. These additional perks can enhance the overall value of the coverage and provide added peace of mind in specific situations.

By taking these factors into consideration, you can ensure that you obtain the right storage insurance coverage for your specific needs and have the necessary protection for your stored items.

Overall, storage insurance is an essential investment when utilizing self-storage facilities. It provides financial security and peace of mind, ensuring that your belongings are protected against unforeseen risks. Don’t overlook the importance of storage insurance when storing your items and take the necessary steps to obtain the right coverage.

Learn about Do you need storage unit insurance.

1 thought on “Insurance for storage unit contents uk”