Introduction

What is Umbrella Insurance and why is it important?

Umbrella insurance is a type of liability insurance that provides additional coverage beyond what your regular homeowners, auto, or other primary insurance policies cover. It is important because it offers an extra layer of protection in case you are sued for damages or injuries that exceed the limits of your primary insurance policies. This can help protect your assets, such as your savings, home, and investments, from being seized to pay for any damages awarded in a lawsuit.

What is a storage unit and why would you need insurance?

A storage unit is a rented space in a facility where individuals or businesses can store their belongings. These units are typically used when you have more items than your home can accommodate, during a move, or when you need secure storage for valuable items. While storage units provide security measures such as locked gates and surveillance cameras, they are not immune to risks such as theft, fire, water damage, or natural disasters. Therefore, it is important to have insurance coverage for the items you store in a storage unit to protect yourself financially in case of any unforeseen events.

Does homeowners insurance cover your storage unit?

While homeowners insurance can provide coverage for items stored in a storage unit, the extent of that coverage can vary depending on your specific policy. Some homeowners insurance policies may offer limited coverage for items in a storage unit, while others may not cover them at all. It is important to review your policy or speak with your insurance provider to understand what is covered and what is not.

What does homeowners insurance typically cover in a storage unit?

Generally, homeowners insurance policies provide coverage for personal property, which includes items stored in a storage unit. However, this coverage is usually subject to certain limitations. For example, your policy may only cover a percentage of the personal property limit stated in your policy, typically around 10%. This means that if your policy has a personal property limit of $100,000, your coverage for items in a storage unit may be limited to $10,000. Additionally, certain types of property, such as jewelry, fine art, collectibles, or business-related property, may have sub-limits or exclusionary clauses in your policy, which means they may not be fully covered or may not be covered at all.

What are the limitations of homeowners insurance for a storage unit?

There are several limitations to be aware of when it comes to homeowners insurance coverage for a storage unit. These limitations can vary depending on your policy, so it is important to review your specific policy or speak with your insurance provider to understand the limitations that apply to you. Some common limitations include:

1. Coverage limits: As mentioned earlier, homeowners insurance policies may only provide a percentage of the personal property limit for items stored in a storage unit.

2. Exclusions: Certain types of property, such as high-value items or business-related property, may have limited or no coverage at all in your homeowners insurance policy for a storage unit.

3. Policy deductibles: Your homeowners insurance policy may have a deductible that applies to claims for items stored in a storage unit. This means that you would be responsible for paying the deductible amount before your insurance coverage kicks in.

4. Loss types: Homeowners insurance typically covers loss or damage caused by specific perils, such as fire, theft, or water damage. However, there may be specific exclusions or limitations for certain types of losses, such as damage caused by floods or earthquakes.

What are your options for additional coverage?

If your homeowners insurance policy does not provide sufficient coverage for the items you store in a storage unit, or if you want more comprehensive coverage, there are several options available:

1. Storage unit insurance: Some storage facilities offer their own insurance options specifically designed to cover the items stored in their units. These policies can provide additional coverage beyond what your homeowners insurance offers, but they may also have their own limitations and exclusions.

2. Stand-alone storage insurance: You can also consider purchasing a stand-alone storage insurance policy from an independent insurance provider. These policies are specifically designed to provide coverage for items stored in a storage unit and can offer more comprehensive protection.

3. Umbrella insurance: Umbrella insurance can also provide additional coverage for items in a storage unit. If you already have an umbrella insurance policy, it is worth checking if it includes coverage for stored belongings. If not, you may be able to add this coverage as an endorsement to your existing policy.

Conclusion

It is important to understand the limitations of your homeowners insurance when it comes to coverage for items stored in a storage unit. While some coverage may be provided, it is often limited and may not fully protect all your valuables. Reviewing your policy, considering additional coverage options, and discussing your needs with your insurance provider can help ensure that you have the necessary protection for your stored belongings.

Understanding Umbrella Insurance

What does Umbrella Insurance cover?

Umbrella insurance is a type of liability insurance that provides coverage beyond the limits of your other insurance policies. It is designed to protect you from major claims or lawsuits that could exceed the coverage provided by your auto, homeowners, or other liability policies. Umbrella insurance kicks in when the limits of your other policies have been exhausted.

Umbrella insurance provides coverage for the following:

1. Personal Injury Liability: This includes coverage for claims of slander, libel, defamation of character, false arrest, and invasion of privacy.

2. Bodily Injury Liability: Umbrella insurance covers you in the event that someone is injured or killed as a result of your negligence. It can provide coverage for medical expenses, pain and suffering, and even legal fees if you are sued.

3. Property Damage Liability: This coverage kicks in if you accidentally damage someone else’s property, such as hitting a parked car or causing damage to someone’s home. Umbrella insurance can help cover the cost of repairs or replacement.

4. Landlord Liability: If you own rental properties, umbrella insurance can provide additional protection in case a tenant or visitor is injured on your property and sues you for damages.

5. Legal Defense Costs: Umbrella insurance can also help cover the costs of legal defense if you are sued for a covered claim. This can include hiring lawyers, court fees, and other expenses related to defending yourself in a lawsuit.

Common claims covered by Umbrella Insurance

Umbrella insurance can provide coverage for a wide range of claims. Some common examples include:

1. Car accidents: If you are involved in a serious car accident and the resulting damages and medical expenses exceed your auto insurance limits, umbrella insurance can help cover the additional costs.

2. Dog bites: If your dog bites someone and they require medical treatment, umbrella insurance can help cover the resulting medical expenses and legal fees if you are sued.

3. Slip and fall accidents: If someone slips and falls on your property and sues you for their injuries, umbrella insurance can provide coverage for their medical expenses and your legal defense costs.

4. Accidental injuries: If you accidentally injure someone while participating in activities such as skiing, boating, or even hosting a party at your home, umbrella insurance can help cover the resulting medical expenses and legal fees.

5. Property damage: If you accidentally cause damage to someone else’s property, such as knocking over an expensive piece of artwork or causing a fire, umbrella insurance can help cover the cost of repairs or replacement.

It is important to note that umbrella insurance does not cover intentional acts or illegal activities. It is also crucial to review your policy carefully and understand the coverage limits and exclusions before making any assumptions about what is covered.

Therefore, umbrella insurance provides an additional layer of liability coverage beyond the limits of your other insurance policies. It can protect you from major claims and lawsuits that could otherwise financially devastate you. Considering the potential risks and the relatively low cost of umbrella insurance, it is a smart investment for anyone looking to protect their assets and future financial security.

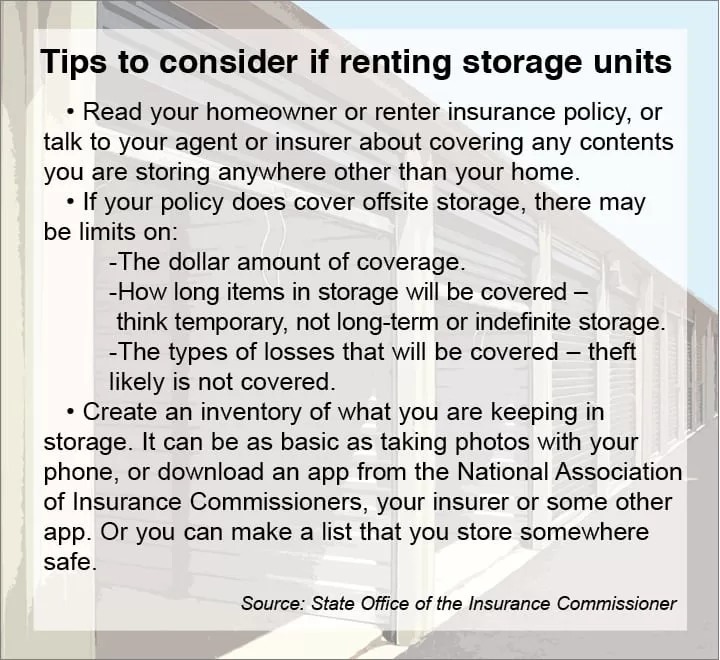

Do I need special insurance for my personal property at a storage unit?

Standard homeowners or renters insurance coverage

Generally, homeowners or renters insurance policies provide coverage for personal property not only within your house but also when it is stored off-premises. This means that if you have homeowners or renters insurance, your belongings in a storage unit may be covered by the off-premises coverage.

Limitations and exclusions of standard insurance policies

However, the amount of coverage and specific conditions can vary depending on your insurance company and the level of coverage you have purchased. It is important to review your policy and understand the limitations and exclusions, as some items may not be covered or may have limited coverage.

Some common limitations of standard insurance policies for storage units include:

– Coverage limits: There may be a limit on the amount of coverage provided for items stored in a storage unit. This means that if the total value of your belongings exceeds this limit, you may not have full coverage for all your items.

– Types of loss covered: Standard insurance policies typically cover loss or damage caused by specific perils, such as fire, theft, or water damage. However, certain perils may be excluded, such as flooding or damage caused by rodents or pests.

– Deductibles: Just like with any insurance policy, there may be a deductible that you would have to pay out-of-pocket before your coverage kicks in. It is important to consider the deductible amount when determining the extent of coverage.

– Documentation: In the event of a claim, you may be required to provide documentation such as receipts or appraisals to prove the value of your stored belongings. It is a good idea to keep a detailed inventory of your items and their estimated value.

It is also worth noting that some storage unit providers may require you to have homeowners or renters insurance as a condition for renting a unit. In such cases, you may need to provide a copy of your insurance policy as proof before signing a contract.

Ultimately, it is recommended to contact your insurance provider to understand the specifics of your coverage for items stored in a storage unit. They can explain the details of your policy and help you determine if additional coverage, such as a separate storage insurance policy or an endorsement to your existing policy, may be necessary.

Remember to review your insurance policy regularly and make updates as needed to ensure your stored belongings are adequately protected.

Does Homeowners Insurance Cover Property in Storage?

Coverage for property in storage units under homeowners insurance

Homeowners insurance typically includes off-premises coverage, which means it can provide protection for your belongings stored in a storage unit. However, the coverage may vary depending on the type of loss and other conditions. Before signing a self-storage unit rental contract, it’s important to review your homeowners insurance policy to ensure you have the coverage you need.

Here are some common scenarios where homeowners insurance may cover your property in a storage unit:

1. Theft: If your belongings are stolen from the storage unit, your homeowners insurance may provide coverage under the personal property coverage portion of your policy. This can help reimburse you for the value of the stolen items.

2. Fire or water damage: If a fire or water damage incident occurs and damages your belongings in the storage unit, your homeowners insurance may cover the cost of repairs or replacement. However, it’s important to note that some policies may have limitations on coverage for water damage, so it’s essential to review your policy in detail.

3. Vandalism: In the unfortunate event of vandalism to your stored belongings, homeowners insurance may provide coverage for the damages caused. This can include acts of vandalism such as graffiti, destruction of property, or intentional damage.

Potential limitations or exceptions

While homeowners insurance can provide coverage for property in storage units, there may be limitations or exceptions to consider. Here are some potential factors that could affect the coverage:

1. Policy limits: Your homeowners insurance policy will have specific limits on how much coverage it provides for off-premises belongings, including those in storage units. It’s important to check these limits to ensure they are sufficient for your valuable items.

2. Valuable items: Homeowners insurance policies often have coverage limits for certain types of valuable items, such as jewelry, artwork, or collectibles. If you have high-value items in your storage unit, it’s important to understand whether your policy provides enough coverage or if additional insurance is needed.

3. Named perils: Some homeowners insurance policies only cover specific perils or hazards. This means that if the damage to your belongings in storage is not caused by a named peril, such as fire or theft, the insurance may not provide coverage. It’s crucial to review the list of covered perils in your policy.

4. Deductible: Like any insurance coverage, homeowners insurance typically has a deductible that you must pay out of pocket before the coverage kicks in. It’s important to consider the deductible amount and whether it is reasonable for the value of the items you have in storage.

5. Special endorsements: Depending on your homeowners insurance policy, you may need to add special endorsements or riders to specifically cover property in storage units. These endorsements can provide additional coverage or extend the existing coverage for off-premises belongings.

It’s worth noting that while homeowners insurance may cover your property in a storage unit, it’s always a good idea to consider additional insurance options specifically designed for self-storage units. These specialized storage unit insurance policies can provide more comprehensive coverage and may offer specific protection for items like wine collections, fine art, or antiques.

Therefore, homeowners insurance can act as storage unit insurance, but the coverage may have limitations and exceptions. It’s crucial to review your policy, check the coverage limits, and consider the value of your stored belongings to ensure you have adequate protection. Additionally, exploring specialized storage unit insurance options can provide you with more comprehensive coverage for your valuable items in storage.

Umbrella Insurance Coverage for Storage Units

Coverage provided by Umbrella Insurance for items in storage

Umbrella insurance is an additional insurance policy that provides extra liability coverage beyond what is typically offered by homeowners insurance. While umbrella insurance may not directly cover the items you store in a storage unit, it can provide added protection in case of certain incidents or accidents.

Here are a few ways that umbrella insurance can provide coverage for items in storage:

1. Liability coverage: Umbrella insurance can offer increased liability coverage, which can be beneficial if someone is injured or their property is damaged while visiting your storage unit. This added protection can help cover legal expenses and potential damages.

2. Legal defense: If you face a lawsuit related to your storage unit, umbrella insurance can help cover the costs of legal defense. This can be particularly useful if someone claims that your stored items caused them harm or that you were negligent in maintaining your storage unit.

3. Personal injury coverage: Umbrella insurance typically includes personal injury coverage, which can protect you if you are accused of libel, slander, or false arrest. While this may not directly relate to your stored items, it can provide overall peace of mind regarding potential legal issues.

The added protection of Umbrella Insurance

In addition to the coverage it provides for liability and legal defense, umbrella insurance offers some added benefits that can be useful for individuals who rent storage units:

1. Increased coverage limits: Umbrella insurance often provides higher coverage limits compared to standard homeowners insurance policies. This can be beneficial if you have valuable items stored in your unit that exceed the limits of your homeowners insurance.

2. Third-party coverage: Umbrella insurance can extend coverage to third parties, meaning it can also protect the property of others that you may be storing in your unit. This can be particularly helpful if you are storing items for friends or family members.

3. Worldwide coverage: Some umbrella insurance policies offer worldwide coverage, which means your stored items are protected not only in your storage unit but also if they are damaged or stolen while traveling or being transported.

It’s important to note that umbrella insurance is typically an additional policy that must be purchased separately from your homeowners insurance. The coverage and limits provided by umbrella insurance may vary depending on the insurance company and policy terms. It’s important to review the details of your umbrella insurance policy to understand the specific coverage it provides for items in storage.

While umbrella insurance can offer added protection for incidents and accidents related to your storage unit, it’s still essential to ensure your homeowners insurance policy adequately covers your stored items. Review your policy, consider any limitations or exceptions, and evaluate whether additional insurance specifically designed for storage units may be necessary.

Therefore, while homeowners insurance can provide coverage for property in storage units, it may have limitations and exceptions. Umbrella insurance can offer additional liability coverage and added protection, but it may not directly cover the items you store in a storage unit. It’s important to review your policies, check coverage limits, and consider the value of your stored belongings to ensure adequate protection. Exploring specialized storage unit insurance options can provide more comprehensive coverage for valuable items in storage.

Liability Coverage for Storage Units

Liability coverage for accidents and incidents in storage units

In addition to protecting your belongings, homeowners insurance may also provide liability coverage for accidents and incidents that occur in your storage unit. This can be helpful if someone is injured or if their property is damaged while on the premises of your storage unit. Here are a few scenarios where liability coverage may come into play:

1. Slip and fall accidents: If someone slips and falls in your storage unit and suffers an injury, your homeowners insurance liability coverage may help cover their medical expenses and any legal fees if they decide to file a lawsuit against you.

2. Property damage: If you accidentally cause damage to someone else’s property while in your storage unit, your liability coverage may help reimburse them for the cost of repairs or replacement.

3. Accidental fires or water damage: If a fire or water-related incident in your storage unit spreads to neighboring units and causes damage to other people’s property, your liability coverage may help cover their losses.

It’s important to note that liability coverage is typically subject to certain limits, so it’s crucial to review your policy and ensure that you have adequate coverage for potential liability claims.

Coverage gaps that Umbrella Insurance can fill

While homeowners insurance may provide liability coverage for incidents in your storage unit, it’s possible that the coverage limits may not be sufficient in some cases. To fill these potential gaps, you may want to consider purchasing an umbrella insurance policy.

Umbrella insurance is an additional liability coverage that extends beyond the limits of your homeowners insurance. It provides an extra layer of protection and can help cover the costs associated with a larger liability claim. This can be especially beneficial if you have high-value assets or if you are concerned about potential lawsuits exceeding your homeowners insurance limits.

When considering umbrella insurance for your storage unit, it’s important to review the terms and conditions of the policy, as coverage may vary depending on the insurance provider. It’s recommended to consult with an insurance professional who can guide you through the process and help you find the coverage that best suits your needs.

Therefore, while homeowners insurance can offer coverage for your property and liability in a storage unit, it’s essential to review your policy and understand any limitations or exceptions. Checking coverage limits, considering the value of your belongings, and exploring additional insurance options such as umbrella insurance can help ensure that you have the adequate protection needed for your storage unit. Remember, always consult with an insurance professional for personalized advice and to find the best insurance solutions for your specific situation.

Umbrella Insurance and Added Protections

Claims typically covered by Umbrella Insurance

Umbrella insurance provides an extra layer of protection that goes beyond the limits of your homeowners insurance. It can offer coverage for a wide range of liability claims, including:

– Personal injury claims: If someone sues you for defamation, libel, or slander, umbrella insurance can help cover the legal fees and any damages awarded.

– Bodily injury claims: If someone is injured on your property or as a result of your actions, umbrella insurance can provide additional coverage for their medical expenses, legal fees, and other related costs.

– Property damage claims: If you accidentally damage someone else’s property, umbrella insurance can help cover the cost of repairs or replacement.

– Lawsuit-related expenses: Umbrella insurance can also provide coverage for legal defense costs, such as attorney fees and court costs.

Additional coverage options for peace of mind

In addition to umbrella insurance, there are other coverage options you may want to consider to ensure your belongings in a storage unit are adequately protected:

– Valuable items coverage: Homeowners insurance typically has coverage limits for high-value items, such as jewelry, artwork, or collectibles. If you have valuable items stored in your storage unit, consider adding extra coverage to protect them fully.

– Flood insurance: Most homeowners insurance policies do not cover damage caused by flooding. If your storage unit is at risk of flooding, purchasing a separate flood insurance policy can help ensure you are protected.

– Earthquake insurance: Similar to flood insurance, earthquake damage is usually not covered by standard homeowners insurance. If you live in an earthquake-prone area or have items stored in a storage unit in such an area, consider adding earthquake insurance to your policy.

– Storage facility insurance: Some storage facilities offer their own insurance options. While these policies may provide additional coverage, it’s important to carefully review the terms and conditions to determine if the coverage is adequate for your needs.

By exploring these additional coverage options and reviewing your homeowners insurance policy, you can have peace of mind knowing that your belongings in a storage unit are well protected. Consult with an insurance professional to discuss your specific needs and find the best insurance solutions for you.

Factors to Consider when Choosing Umbrella Insurance for Storage Units

Determining the right level of coverage for your storage unit

When selecting umbrella insurance for your storage unit, it’s essential to consider the appropriate level of coverage. Here are some factors to keep in mind:

1. Evaluate your current homeowners insurance coverage: Review your homeowners insurance policy to determine the limits of your existing liability coverage. This will help you understand the potential gaps that umbrella insurance can fill.

2. Assess the risks associated with your storage unit: Consider the likelihood of accidents or incidents occurring in your storage unit. Factors such as the location of the storage facility, security measures in place, and the condition of the unit can impact the potential risks. Understanding these risks will help you determine the level of coverage you need.

3. Account for potential liability claims: Think about the possible scenarios where you could be held liable for property damage or injuries that occur in your storage unit. Consider the value of the stored belongings and the potential costs that could arise from a liability claim. This will help you assess the appropriate coverage limit for your umbrella insurance policy.

Considering the value of your stored belongings

Another crucial factor when selecting umbrella insurance for your storage unit is the value of the belongings you store. Here are some points to consider:

1. Take inventory of your stored items: Make a detailed inventory of the items you plan to store in your unit. Include their estimated value, as this will help you determine the appropriate amount of coverage needed.

2. Assess the monetary value of your belongings: Determine the overall worth of your stored items. This can include furniture, electronics, clothing, collectibles, and other valuable possessions. Consider any high-value items separately, as they may require additional coverage or be subject to specific policy limits.

3. Review the coverage provided by your homeowners insurance: Understand the extent of coverage offered by your homeowners insurance for off-premises belongings. This will help you identify any gaps that umbrella insurance can fill to adequately protect the value of your stored belongings.

Therefore, choosing the right umbrella insurance for your storage unit requires assessing your current homeowners insurance coverage, evaluating the risks associated with your storage unit, determining the appropriate coverage level, and considering the value of your stored belongings. By carefully considering these factors and consulting with an insurance professional, you can ensure that you have the adequate protection needed for your storage unit. Remember, umbrella insurance provides an additional layer of liability coverage beyond the limits of your homeowners insurance, offering peace of mind and financial security.

Conclusion

The benefits of Umbrella Insurance for storage units

Umbrella insurance provides an additional layer of liability coverage beyond the limits of your homeowners insurance. This can be especially beneficial when it comes to protecting your belongings in a storage unit. Here are some of the benefits of umbrella insurance for storage units:

1. Increased liability coverage: Umbrella insurance offers higher liability coverage, which can help protect you financially in the event that someone is injured or their property is damaged in your storage unit. This can provide you with peace of mind knowing that you have added protection beyond your homeowners insurance.

2. Protection against lawsuits: If someone files a lawsuit against you for an incident that occurred in your storage unit, umbrella insurance can help cover legal costs and any potential damages awarded. This can save you from having to pay out of pocket for expensive legal fees.

3. Flexibility in coverage: Umbrella insurance can be tailored to your specific needs and provide coverage for a wide range of scenarios. This can include coverage for theft, fire, water damage, and other covered perils that may occur in your storage unit.

Making an informed decision

When it comes to selecting umbrella insurance for your storage unit, it’s important to make an informed decision. Here are some tips to help you choose the right coverage:

1. Consult with an insurance professional: Talk to an insurance agent who specializes in umbrella insurance to ensure that you understand your options and choose the coverage that aligns with your needs and budget.

2. Compare different insurance providers: Obtain quotes from multiple insurance providers to compare coverage options and premiums. This will help you find the best policy that offers the coverage you need at a competitive price.

3. Read the fine print: Carefully review the terms and conditions of the umbrella insurance policy, including any exclusions or limitations. Make sure you understand what is covered and what is not.

By considering these factors and taking the time to evaluate your needs, you can make an informed decision when choosing umbrella insurance for your storage unit. Remember, it’s important to regularly review and update your insurance coverage to ensure that you have adequate protection for your stored belongings.

Here’s an interesting read on Insurance for storage unit contents uk.